E-Filing of Appeals Linked to Manually Filed APL-01 to Begin from this Date: GSTAT Portal Replies to Ticket Raised

The appeals linked to orders or notices dated before 31 January 2022 can be filed between 24 September and 31 October 2025, with subsequent windows notified until March 2026

In response to a ticket on the GSTAT portal regarding the non-availability of e-filing functionality for certain appeals, the GSTN has said that the E-filing of Appeals functionality Not Enabled Where First Appeal in FORM GST APL-01 Was Filed Manually .

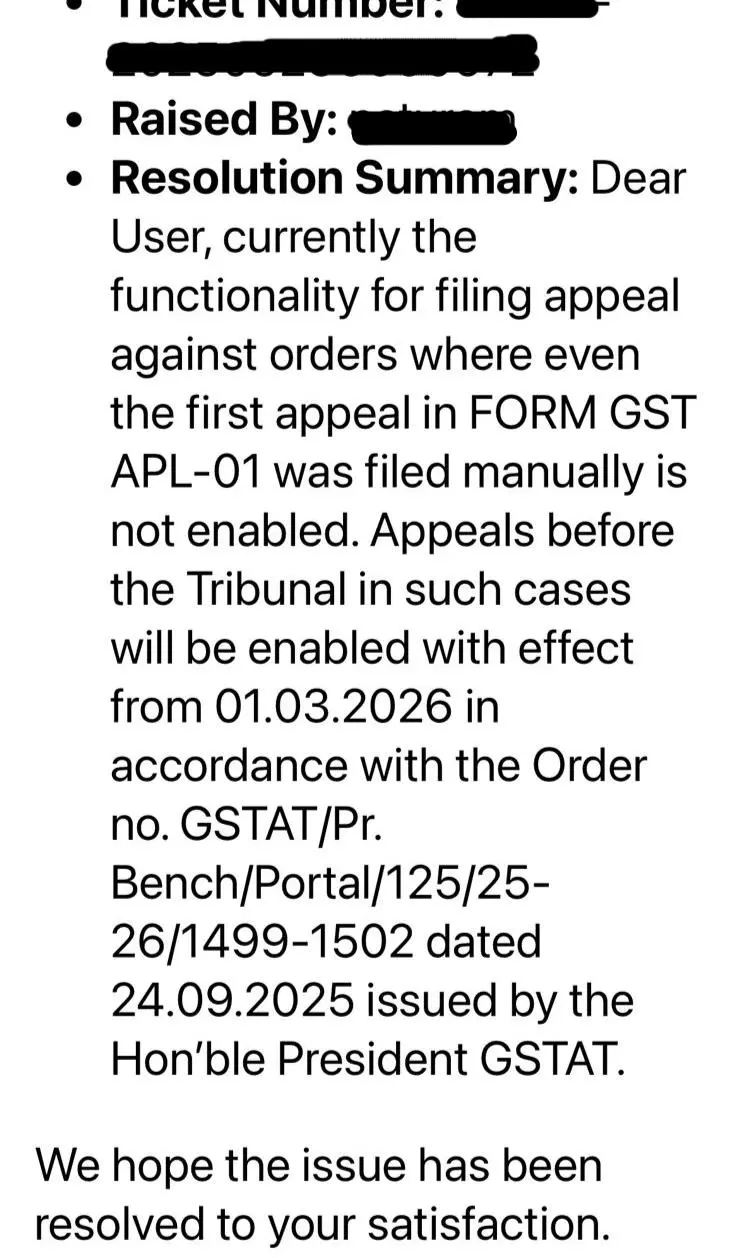

Taxpayer/ Tax Professional had reported difficulties in filing appeals before the Goods and Services Tax Appellate Tribunal (GSTAT) in cases where the first appeal in FORM GST APL-01 was originally filed manually, and the corresponding Order-in-Appeal (OIA) was not uploaded on the GST portal. He raised a ticket regarding the same.

The GSTN has clarified that at present, the system does not support electronic filing of such appeals. However, in accordance with Order No. GSTAT/Pr.Bench/Portal/125/25-26/1499-1502 dated 24.09.2025, issued by the President of GSTAT, the functionality to enable filing of these appeals will be made available with effect from 01 March 2026.

The portal replied that “Dear User, currently the functionality for filing appeal against orders where even the first appeal in FORM GST APL-01 was filed manually is not enabled. Appeals before the Tribunal in such cases will be enabled with effect from 01.03.2026 in accordance with the Order no. GSTAT/Pr. Bench/Portal/125/25-26/1499-1502 dated 24.09.2025 issued by the Hon'ble President GSTAT.”

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

The tribunal has issued a detailed User Advisory on the new e-filing portal for second appeals under Section 112 of the CGST Act. The advisory prescribes a staggered filing schedule up to 31 March 2026, depending on the ARN/CRN of the first appeal (APL-01/03) or notice (RVN-01).

The appeals linked to orders or notices dated before 31 January 2022 can be filed between 24 September and 31 October 2025, with subsequent windows notified until March 2026. Missed timelines can be regularized until 30 June 2026, while APL-04 orders issued after 1 April 2026 must be appealed within the standard three-month statutory period.

For cases where ARN/CRN is not traceable, filing will open from midnight of 31 December 2025 until 30 June 2026. GSTAT has advised users to first complete the offline Excel draft filing sheet and keep scanned documents ready including the impugned order, APL-04 if unavailable online, pre-deposit challans, affidavits, and vakalatnamas in PDF format with a 20 MB size cap per file.

Get the GSTAT Order here: GST Second Appeale-Filing: GSTAT issues User Advisory for New GSTAT E-Filing Portal [ReadAdvisory]

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates