Begin typing your search above and press return to search.

![STBA Flags Burden of High GSTAT Appeal Fees, Seeks Intervention from CBIC, Finance & Law Ministries [Read Order] STBA Flags Burden of High GSTAT Appeal Fees, Seeks Intervention from CBIC, Finance & Law Ministries [Read Order]](https://images.taxscan.in/h-upload/2026/02/05/500x300_2123878-stba-flags-burden-high-gstat-appeal-fees-seeks-intervention-cbdt-finance-law-ministries-taxscan.webp)

STBA Flags Burden of High GSTAT Appeal Fees, Seeks Intervention from CBIC, Finance & Law Ministries [Read Order]

The Sales Tax Bar Association (STBA) has flagged the burden of high appeal fees for filing matters before the Goods and Services Tax Appellate...

![GST Registration Found Not Credible, Fails to File Returns: Madras HC Refuses to Condone 418-Day Delay in Appeal [Read Order] GST Registration Found Not Credible, Fails to File Returns: Madras HC Refuses to Condone 418-Day Delay in Appeal [Read Order]](https://images.taxscan.in/h-upload/2026/01/30/250x150_2122557-gst-registration-found-not-credible-fails-to-file-returns-madras-hc-refuses-to-condone-418-day-delay-in-appeal-taxscan.webp)

![Builder Required to Pass on GST ITC Benefits to Homebuyers: GSTAT Directs Buyer-Wise Refund of ₹1 Cr Profiteered Amount [Read Order] Builder Required to Pass on GST ITC Benefits to Homebuyers: GSTAT Directs Buyer-Wise Refund of ₹1 Cr Profiteered Amount [Read Order]](https://images.taxscan.in/h-upload/2026/01/27/250x150_2122009-builder-required-pass-gst-itc-benefits-homebuyers-gstat-directs.webp)

![‘GSTAT Now Functional’: Telangana HC Directs to File Appeal Before Tribunal, Denies Adjustment of Tax Paid as Pre-Deposit [Read Order] ‘GSTAT Now Functional’: Telangana HC Directs to File Appeal Before Tribunal, Denies Adjustment of Tax Paid as Pre-Deposit [Read Order]](https://images.taxscan.in/h-upload/2025/11/05/500x300_2102583-gstat-telangana-hc-adjustment-of-tax-pre-deposit-file-appeal-before-tribunal-taxscan.webp)

![No GSTAT, No Recovery: Delhi HC stays GST Recovery Proceedings subject to Pre-Deposit [Read Order] No GSTAT, No Recovery: Delhi HC stays GST Recovery Proceedings subject to Pre-Deposit [Read Order]](https://images.taxscan.in/h-upload/2025/10/27/500x300_2100264-no-gstat-recovery-delhi-hc-gst-recovery-proceedings-pre-deposit-txn.webp)

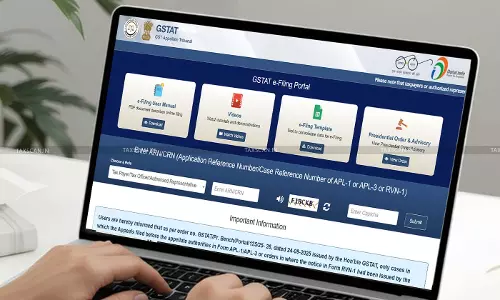

![[Exclusive] 10 Days in Since Launch But Zero GST Appeals e-filed so far! GSTAT yet to be Functional? [Exclusive] 10 Days in Since Launch But Zero GST Appeals e-filed so far! GSTAT yet to be Functional?](https://images.taxscan.in/h-upload/2025/10/04/500x300_2093885-e585abf2-90db-4277-ac62-b7824861e2c3.jfif)

![Procter & Gamble Not Liable to Pay 18% Interest on Profiteered Amount as it Happened in 2018: GSTAT [Read Order] Procter & Gamble Not Liable to Pay 18% Interest on Profiteered Amount as it Happened in 2018: GSTAT [Read Order]](https://images.taxscan.in/h-upload/2025/09/12/500x300_2085966-gstat-procter-gamble-not-liable-taxscan.webp)