[Exclusive] Meerut CA ITR Refund Scam: Salaried Taxpayer Still Left to Suffer after Crackdown!

Among numerous victims caught in the crossfire are salaried individuals whose lives turned upside down when he inadvertently became tangled in this elaborate tax fraud

![[Exclusive] Meerut CA ITR Refund Scam: Salaried Taxpayer Still Left to Suffer after Crackdown! [Exclusive] Meerut CA ITR Refund Scam: Salaried Taxpayer Still Left to Suffer after Crackdown!](https://images.taxscan.in/h-upload/2025/07/17/2064722-meerut-ca-itr-refund-scam-ca-itr-refund-scam-itr-refund-scam-itr-refund-ca-taxscan.webp)

In a startling exposé revealing the vulnerabilities within the income tax filing ecosystem, salaried taxpayers are grappling with hefty penalties following a major crackdown by the Income Tax Department (ITD) on Meerut-based NYG and Associates, a Chartered Accountants’ (CA) firm accused of large-scale fraudulent practices. Among numerous victims caught in the crossfire is a salaried individual (name withheld to protect identity) from Gurgaon, whose life turned upside down when he inadvertently became tangled in this elaborate tax fraud.

The individual's ordeal began when he received a seemingly routine email from the ITD in late 2023, prompting him to verify a pending Income Tax Return (ITR). Engaged in a personal crisis due to his mother’s medical condition, he swiftly e-verified the return, mistakenly assuming it related to his earlier filings. Being an honest, law-abiding taxpayer, the victim went on with his normal life.

Little did he realize that this simple action would embroil him in a massive tax evasion scam orchestrated by employees of NYG and Associates, specifically pointing towards Nancy Agarwal, a “self-proclaimed” Chartered Accountant associated with the firm. Documents obtained from the individual show a revised ITR filed without his consent, drastically lowering his taxable income and resulting in an unauthorized refund from the Income Tax Department.

"Nancy filed my revised ITR without my approval. I was in the midst of attending to my mother’s critical medical condition. The refund alert from the Income Tax Department was the first indicator of something being amiss," the individual revealed in his detailed complaint lodged with the cybercrime portal, highlighting the misuse of digital credentials and unauthorized filing.

The UAE Tax Law Is Evolving — Stay Ahead Before Clients Find Someone Who Already Is, Enroll Now

Once alerted, the individual confronted Nancy Agarwal, whose WhatsApp conversations explicitly reflect an attempt to downplay the severity, asserting initially that no corrective measures could be taken. When subsequently issued a notice by the Income Tax for scrutiny under Section 143(3)of the Income Tax Act, he immediately filed an Updated Return (ITR-U), voluntarily paying a huge amount to settle the discrepancies.

After six despite his prompt response and payment of full taxes and interest, issuing another notice under Section 270A for under-reporting and misreporting income, the authorities slapped an exorbitant penalty, 200% of the assessed underreported tax.

The penalty order categorically accused him of "suppression of facts," claiming under-reporting of income. "This penalty is disproportionate," the individual's appeal to the Commissioner of Income-tax (Appeals) states, "given my earnest efforts to rectify an error that wasn’t even of my making."

Further investigation reveals the coercive methods employed by Nancy Agarwal to extract additional payments under the guise of resolving IT notices. WhatsApp transcripts vividly capture Nancy demanding a 35% commission on refunds, blatantly stating that "bigger refunds attract bigger commissions."

Facing threats of non-compliance with IT notices if commissions were unpaid, the individual reluctantly transferred payments to multiple accounts, including one belonging to a certain Yashi Gupta.

Notably, one of the victims made a website: Nancy Aggarwal

Also, a blog has surfaced alerting the taxpayers of the TDS refund scam - https://itrfraud.blogspot.com/2024/11/scam-alert-beware-of-tds-refund-fraud.html

A detailed cybercrime complaint underscores his plight, alleging that the “CA” involved allegedly misused his credentials to file fraudulent returns, thereby incurring substantial financial penalties, legal entanglements, and immense psychological distress. It later came to the victim’s knowledge that the one who filed the return was not even a fully qualified Chartered Accountant.

The UAE Tax Law Is Evolving — Stay Ahead Before Clients Find Someone Who Already Is, Enroll Now

The ripple effects of the raid on NYG and Associates and the consequent scrutiny have brought to light numerous similar cases, indicating blatant exploitation by certain unscrupulous chartered accountant firms preying on vulnerable salaried taxpayers. This individual's case is emblematic of major uprising concerns about professional malpractice among tax practitioners and weak oversight mechanisms within the income tax filing industry.

The affected individual is currently battling his penalty order through the formal income tax appellate process.

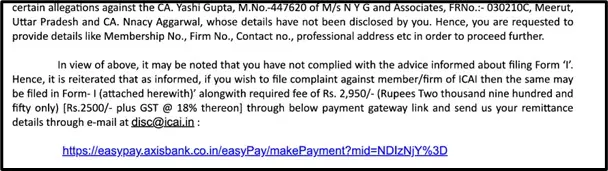

The Institute of Chartered Accountants of India (ICAI), upon receiving multiple complaints, has initiated inquiries, but tangible relief remains elusive for many affected taxpayers. Notably, the institute has requested the already financially drained taxpayer to remit a fee of Rs.2500/-+GST.

With a rising number of individuals stepping forward with similar allegations, experts expect a comprehensive revamp in the verification processes and enhanced cybersecurity protocols within tax filing systems to prevent such misuse. This case, a cautionary tale of exploitation, stresses the immediate need for law reforms and vigilant taxpayer awareness to combat rampant frauds in India's income tax landscape.

Hopefully, the system will evolve to a future where professionals, who file returns without verifying claims will be held liable instead of honest taxpayers who are left in the dark, unaware of the scams involved and complexities of the income tax regime.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates