From Fish to Fish Oil: GST Council Slashes Rates on Seafood Sector

The historic GST Rate cuts are said to transition India’s indirect tax regime to a truly “Good and Simple Tax”.

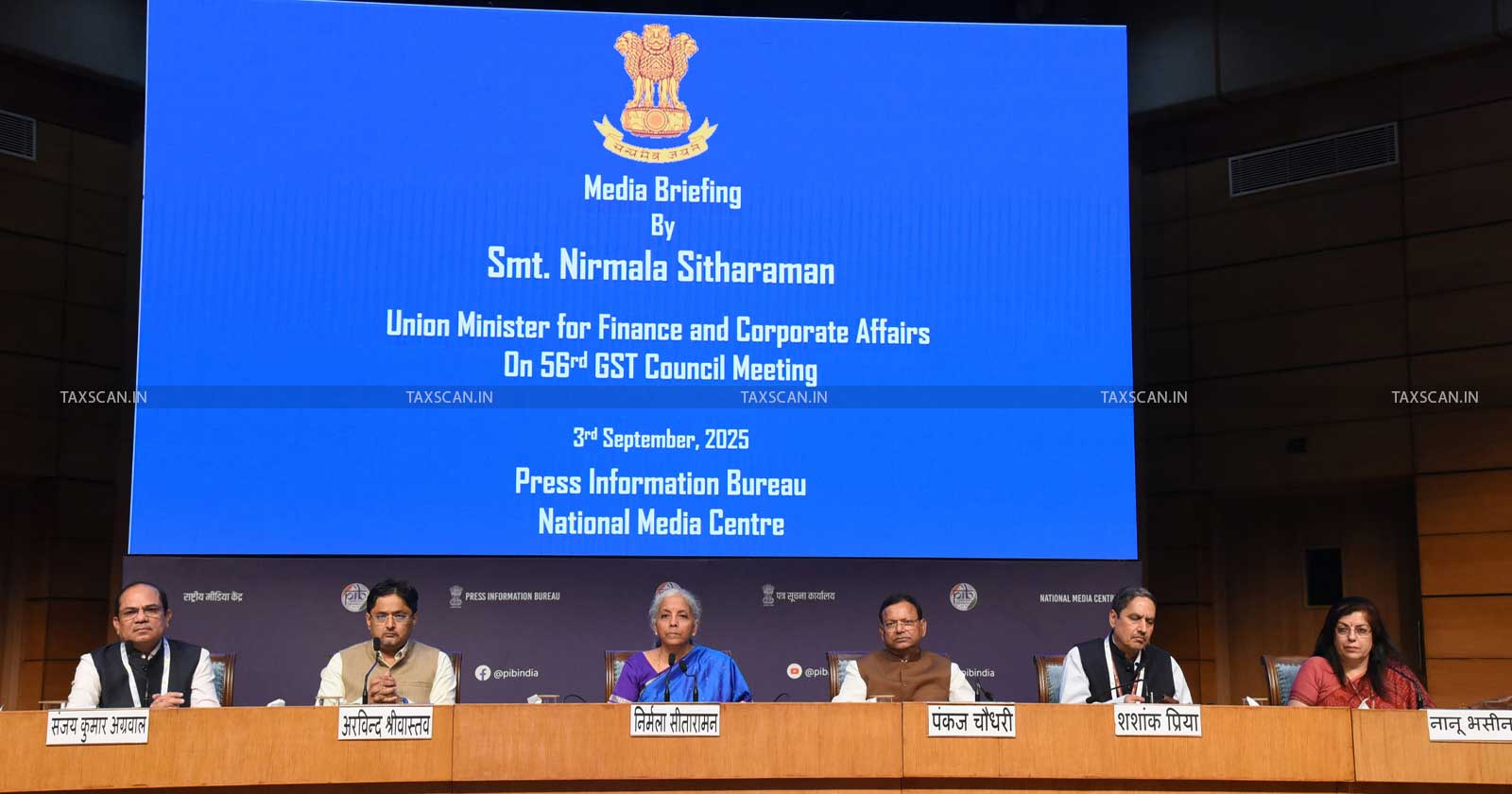

The 56th meeting of the Goods and Services Tax (GST) Council was held on 3rd September 2025 at Sushma Swaraj Bhavan in New Delhi under the aegis of Union Finance Minister Nirmala Sitharaman.

Among the various sweeping changes that have been effected to the GST regime, a notable rate rationalization process has been done to India’s fisheries and aquaculture sector.

The Council has recommended important rate rationalisation measures that are expected to cut down operational costs, strengthen export and directly benefit millions of stakeholders whose livelihoods are dependent on fishing and aquaculture sectors.

As per the revised GST structure, seafood products and derivatives including fish oils, fish extracts and prepared or preserved fish and shrimp products, which were earlier taxed at 12 percent, will now attract a reduced rate of 5 percent.

Processing units, exporters and domestic consumers are set to receive the benefits of the revised rates, possibly increasing India’s global stature in the value-added seafood sector. The rate cut is expected to improve India’s position as the world’s largest shrimp exporter and bolster seafood exports which had crossed a record amount of ₹60,000 crores in 2023–24.

The Council has effected changes to the rate structures on allied sectors as well. Diesel engines, pumps, aerators and sprinklers, which were previously under the 12 to 18 percent bracket, will now be taxed at 5 percent, easing the operational burden for fish farmers and hatcheries.

Requisite chemicals such as ammonia and micronutrients, necessary for pond preparation and water quality management will also shift to the 5 percent slab, in a bid to ensure lower input costs for feed and conditioning of the seafood.

Composting machines vital for eco-friendly pond management have similarly been reduced to 5 percent, boosting the drive towards organic farming and environmental awareness.

Equipment such as fishing rods, tackle, landing nets, butterfly nets and other gear also face a GST rate cut from 12 percent to 5 percent, benefiting both recreational fishers and small-scale aquaculture farmers who rely on such equipment for daily operations. Relief has also been extended to the processing industry through a reduction in GST on job work services in food and agro-processing, including seafood, from 12 percent to 5 percent.

All things considered, India's fisheries sector can be said to have received a comprehensive GST revision, which is especially important as India’s seafood industry is one of the fastest growing in the world, contributing nearly 195 lakh tonnes of production in 2024-25 and supporting over three crore livelihoods.

Also Read:Good News for Foodies! GST Council suggests Nil GST on Paratha, Parotta and other Indian Breads

Also Read:Good News for Foodies! GST Council suggests Nil GST on Paratha, Parotta and other Indian Breads

The revised rates are set to come into effect from 22nd September 2025. Policymakers have touted the cuts and revisions in the seafood and aquaculture industry as part of a wider strategy to strengthen the Blue Economy, support rural livelihoods and help realise the vision of Viksit Bharat. Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates