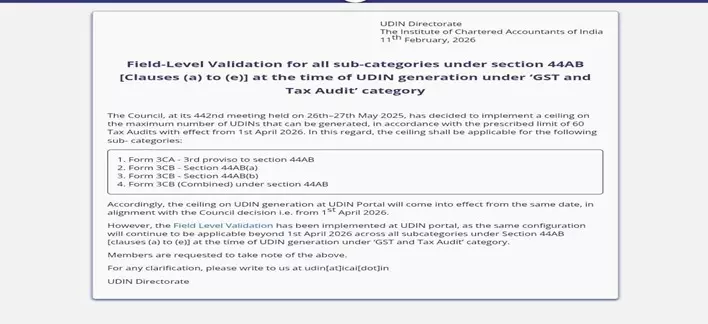

ICAI Tightens UDIN Rules: Field-Level Validation Live, 60 Tax Audit Cap per Partner from April 1, 2026

The ceiling on the UDIN portal will come into effect from the same date, in alignment with the council decision from 1st April 2026

The Institute of Chartered Accountants of India (ICAI) has tightened rules for UDIN (unique document identification number) generation in tax audits, rolling out field-level validation across all section 44AB sub- categories [clauses (a) to (e)] and announcing a ceiling of 60 Tax Audit UDINs per partner effective April 1, 2026.

At its 442nd council meeting, ICAI resolved to implement field-level validation across all sub-categories under Section 44AB [Clauses (a) to (e)] during UDIN generation in the ‘GST and Tax Audit’ category. This validation ensures that CAs must accurately input prescribed details before a UDIN can be generated, thereby strengthening compliance and reducing errors.

Effective 1 April 2026, ICAI will enforce a ceiling of 60 tax audit UDINs per partner in a financial year. This cap aligns with the statutory limit on tax audits under Section 44AB and applies to:

- Form 3CA (statutory audit cases under the third proviso to Section 44AB)

- Form 3CB (cases under Section 44AB(a) and 44AB(b))

- Form 3CB (Combined) under Section 44AB.

By combining stricter validation with a numerical ceiling, ICAI aims to:

- Strengthen audit discipline.

- Prevent over-certification beyond permissible limits.

- Enhance trust in tax audit documentation.

UDIN will now generate only after the statutory validation logic is satisfied, and the audit discipline is moving from guidance to system enforcement.

Also Read:ITAT Directs Deletion of ₹70L Unexplained Cash Deposit on Education Society after finding Records in Audited Books [Read Order]

Also Read:ITAT Directs Deletion of ₹70L Unexplained Cash Deposit on Education Society after finding Records in Audited Books [Read Order]

What is UDIN?

UDIN (Unique Document Identification Number) is a system introduced by ICAI to authenticate documents certified by Chartered Accountants (CAs). It ensures transparency, prevents misuse of signatures, and allows regulators/clients to verify that a document was genuinely issued by a CA.

By concluding this, ICAI has tightened controls on UDIN generation for tax audits. Field-level validation ensures accuracy now, and from April 2026, a hard cap of 60 tax audit UDINs per partner will apply, covering Forms 3CA and 3CB

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates