Income Tax Dept Enables Online Filing of ITR-2

It was directed to Visit: https://incometax.gov.in/iec/foportal/ for the same.

Today, through the official X account, the Income Tax Department has informed that it has enabled the Income Tax Return Form of ITR-2 for filing through online mode with pre-filled data at the e-filing portal. It was directed to Visit: https://incometax.gov.in/iec/foportal/ for the same.

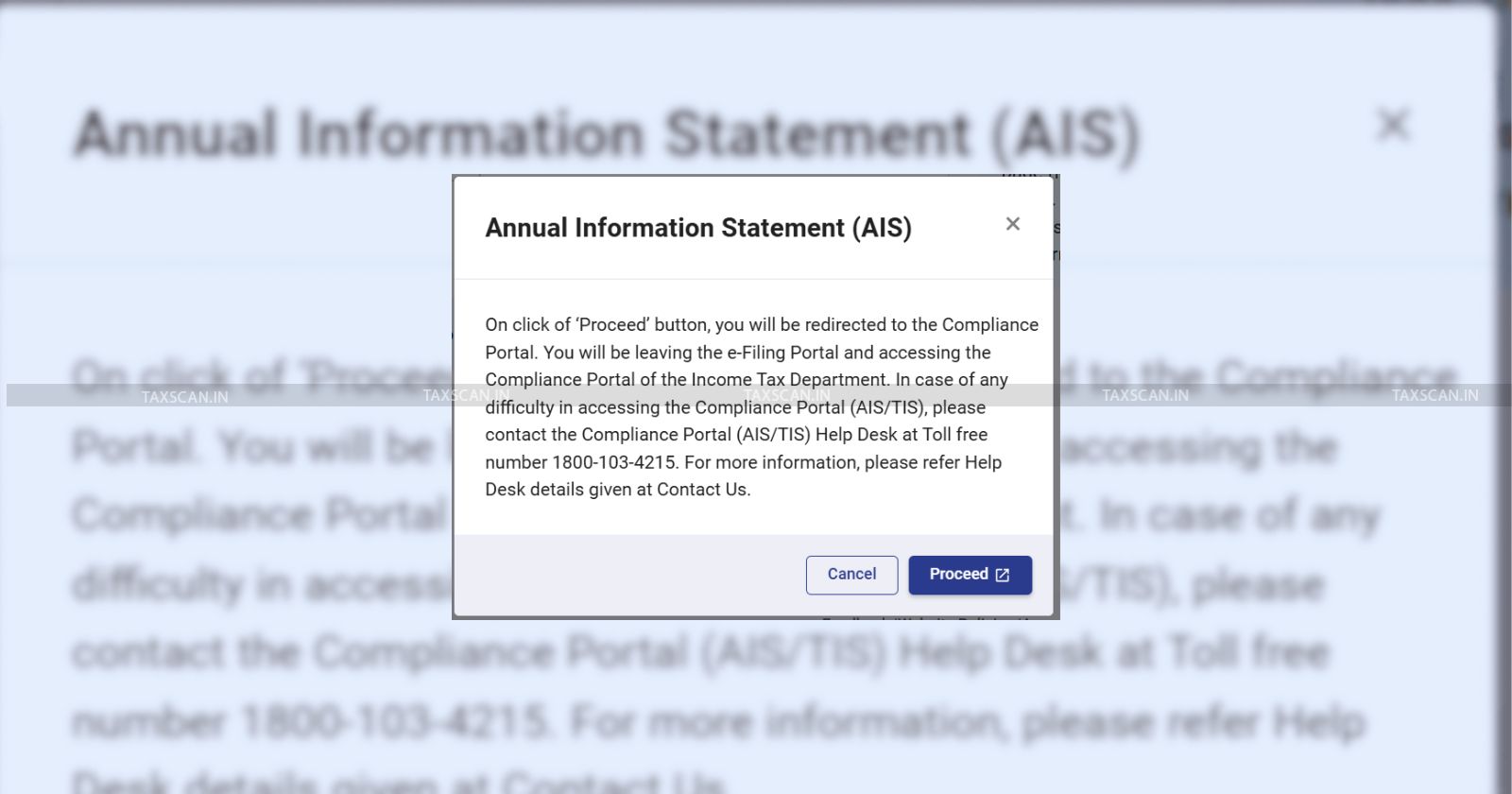

Only the Excel tool for ITR-2 (and ITR-3) was previously made available on July 11, 2025. The application had to be downloaded, filled out offline, converted to a JSON file, then uploaded to the electronic filing system. The process is now easier to use, though, as taxpayers can file ITR-2 straight on the e-filing portal with pre-filled data now that the online option is available.

Want a deeper insight into the Income Tax Bill, 2025? Click here

ITR 2 is applicable for individuals and Hindu Undivided Families (HUFs) whom have no income from "profit and gains of business or profession".

How to File ITR-2 Online?

- Go to the official income tax e-filing portal.

- Enter your password and PAN (User ID) to log in.

- To access 'e-File', select 'Income Tax Returns', then 'File Income Tax Return'.

- Select the 'Online' mode after selecting Assessment Year '2025-26'.

- Choose between 'Individual' and 'HUF' as your filing status.

- After selecting ITR-2, continue entering the information in the different schedules. Editing and reviewing pre-filled data will be possible.

- Once all the information has been filled out, check the tax calculation, settle any outstanding taxes, and file the return.

- Fill out the filing process by e-verifying your return.

Support our journalism by subscribing to Taxscanpremium. Follow us on Telegram for quick updates