Mandatory PAN & Aadhaar Verification in Property Transactions Likely Soon as Income Tax Dept. Tracks Fake PANs in Property Deals [Read Order]

Sources quote that the government is soon expected to issue detailed guidelines or a notification effectuating the same

![Mandatory PAN & Aadhaar Verification in Property Transactions Likely Soon as Income Tax Dept. Tracks Fake PANs in Property Deals [Read Order] Mandatory PAN & Aadhaar Verification in Property Transactions Likely Soon as Income Tax Dept. Tracks Fake PANs in Property Deals [Read Order]](https://images.taxscan.in/h-upload/2025/10/07/2094613-pan-aadhaar-verification-property-transactions-mandatory-pan-aadhaar-verification-taxscan.webp)

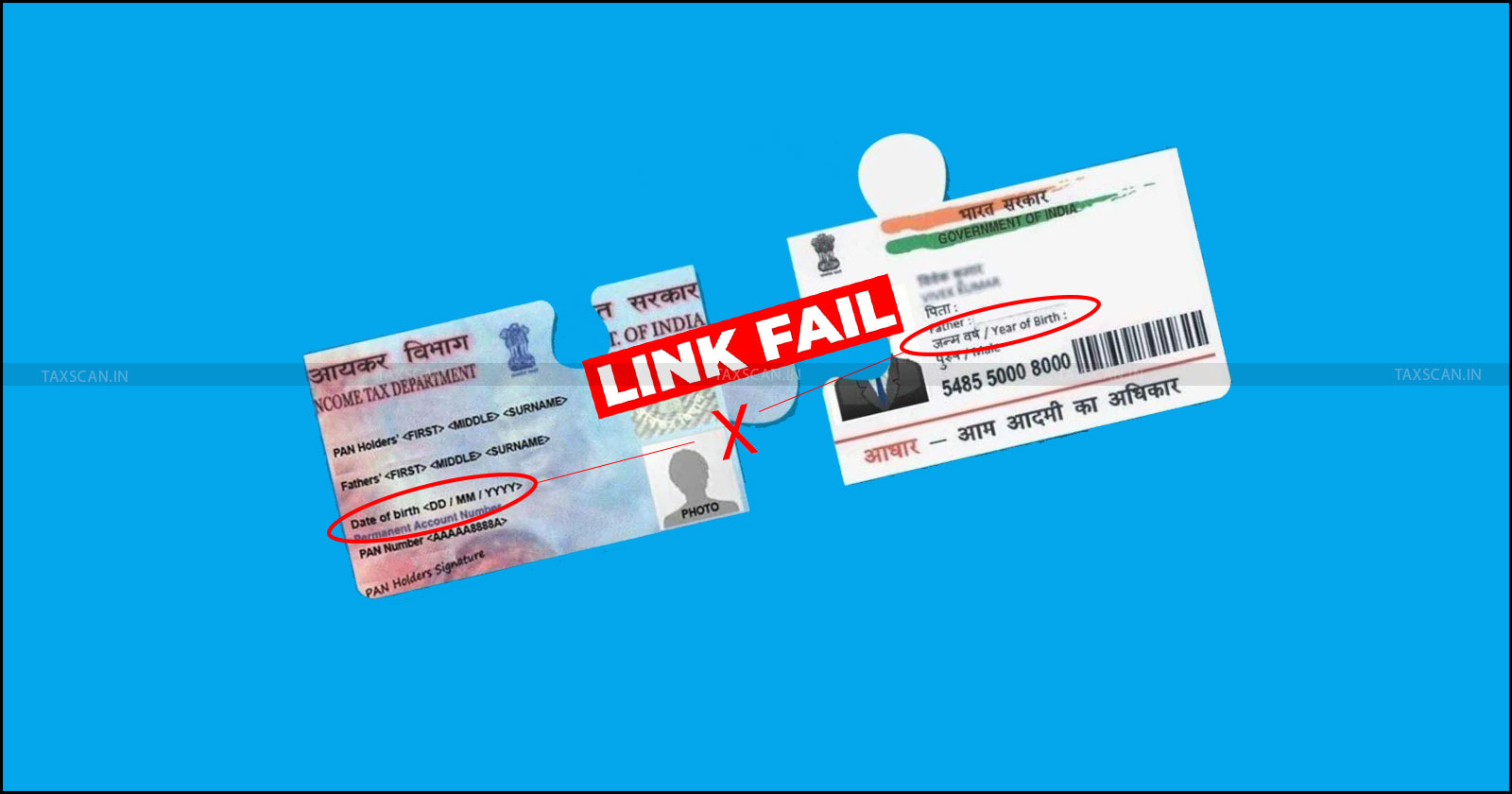

In a bid to tighten compliance and curb tax evasion in the real estate sector, the Income Tax Department is planning to mandate e-verification of Permanent Account Number (PAN) and Aadhaar details to conduct property registration. The department is contemplating the decision following the detection of widespread use of fake or incorrect PANs in high-value property transactions across several states in the nation.

Also Read:PAN-Aadhaar Link Fails Due to Date of Birth Mismatch? Follow This Income Tax Dept Guidance

Also Read:PAN-Aadhaar Link Fails Due to Date of Birth Mismatch? Follow This Income Tax Dept Guidance

As per reports, the Intelligence and Criminal Investigation (I&CI) Wing of the Income Tax Department has unearthed numerous instances where fake or mismatched PANs were used by buyers and sellers in property deals exceeding ₹30 lakh. Investigations revealed that such falsification of entries have miscreants including individuals and shell entities to hide ownership, misreport income and evade taxes linked to purchase of properties.

Accordingly, the Income Tax Department has launched a nationwide inspection of registrar offices, focusing on the verification of PAN details quoted in sale deeds and registration documents. The move is aimed to thwart a key loophole in property reporting that enables benami and unaccounted transactions to slip past the tax net.

Understanding Common Mode of Tax Evasion with Practical Scenarios, Click Here

Electronic Cross-Verification

Officials have indicated that the proposed reform will involve electronic cross-verification of PAN and Aadhaar at the time of registration to confirm the identity of both parties to the transaction. This method would ensure that any PAN used in a property deal is genuine and validly linked with the corresponding Aadhaar number, effectively eliminating the use of bogus credentials.

Also Read:Sale of Trust Property to Trustee Below Market Value: ITAT Grants S.11 Exemption after Full Payment [Read Order]

Also Read:Sale of Trust Property to Trustee Below Market Value: ITAT Grants S.11 Exemption after Full Payment [Read Order]

Preliminary surveys conducted in cities such as Varanasi, Lucknow, Gorakhpur, Kanpur, Jaipur, Bhopal and Indore have already flagged irregularities where registrar records did not match PAN databases or where details were left blank or forged. In certain cases, cooperative banks were also found to have failed in reporting large deposits and withdrawals linked to property transactions.

The latest data-driven push by the Department is indicative of a broader effort to integrate real estate registries, banking information and income disclosures for real-time monitoring of high-value transactions. Sources quote that the government is expected to issue detailed guidelines or a notification soon, making e-verification a precondition for property registration.

Also Read:House sold for ₹67 lakh but only ₹1,690 shown in ITR: Know how Section 54 exemption helped secure relief [Read Order]

Also Read:House sold for ₹67 lakh but only ₹1,690 shown in ITR: Know how Section 54 exemption helped secure relief [Read Order]

Tax experts have welcomed the initiative, noting that mandatory PAN-Aadhaar authentication would effectively curb benami holdings, increase black money detection, enhance transparency and aid in better identifying the trail of real estate ownership and funding.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates