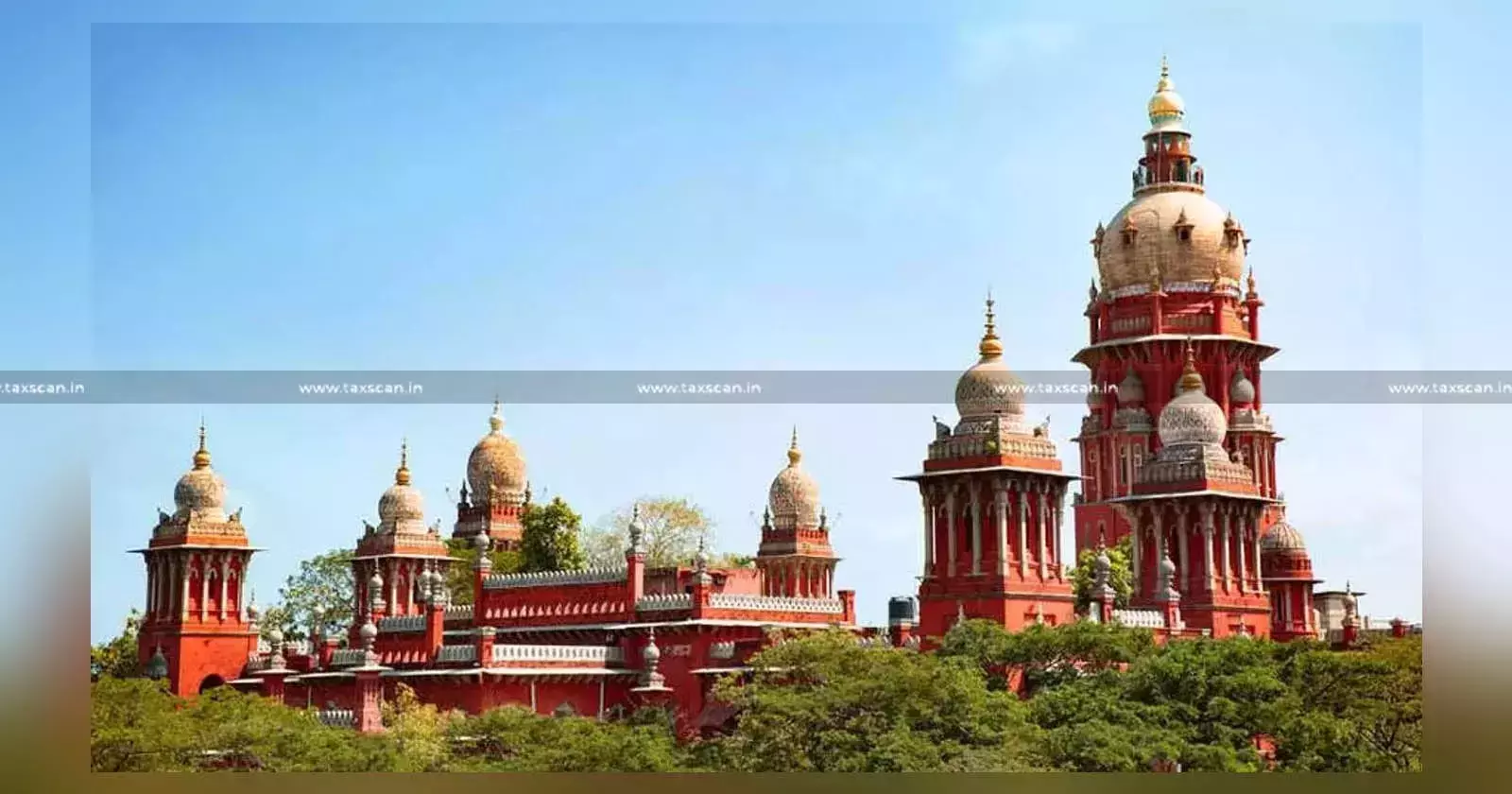

No Fraud in Apollo Tyres’ Supply of Tyres, Tubes & Flaps as “Composite Supply” upon Voluntary Payment of Higher Tax: Madras HC [Read Order]

The Court noted that there was no wilful misstatement, or suppression when they make voluntary payment of higher tax on the supply.

![No Fraud in Apollo Tyres’ Supply of Tyres, Tubes & Flaps as “Composite Supply” upon Voluntary Payment of Higher Tax: Madras HC [Read Order] No Fraud in Apollo Tyres’ Supply of Tyres, Tubes & Flaps as “Composite Supply” upon Voluntary Payment of Higher Tax: Madras HC [Read Order]](https://images.taxscan.in/h-upload/2025/12/06/2110595-no-fraud-apollo-tyres-supply-tyres-tubes-flaps-tax-madras-hc-taxscan.webp)

The Madras High Court recently quashed a Goods and Services Tax (GST) show cause notice, order-in-original, and appellate order issued against Apollo Tyres Ltd., holding that the company’s supply of tyres, tubes, and flaps (TTF), treating the same as “composite supply” does not constitute fraud, wilful misstatement, or suppression when they make voluntary payment of higher tax on the supply.

The present writ petition before the Madras High Court arose from proceedings initiated by theDirectorate General of GST Intelligence (DGGI) and the Chennai GST Commissionerate, which alleged that Apollo Tyres had short-paid GST by misclassifying its supply of TTFas individual items instead of a single composite supply taxable at 28%.

Also Read:Income Tax Demands Against Empee Distilleries Extinguished After Approval of Resolution Plan: Madras HC [Read Order]

Also Read:Income Tax Demands Against Empee Distilleries Extinguished After Approval of Resolution Plan: Madras HC [Read Order]

Apollo Tyres contended that the supply of TTF was initially treated separately due to industry-wide ambiguity following the GST rate changes which reduced the effective tax rate on tubes and flaps from 28% to 18% in late 2017 and early 2019.

To remove any confusion and “buy peace,” the company voluntarily decided on 12 January 2019 to treat the bundled supply as a composite supply and pay the differential tax along with interest. A sum of ₹5 crore was subsequently paid in May 2022, before issuance of the show cause notice dated 20 April 2022.

However, the Department invoked Section 74 of the Central Goods and Services Tax Act, 2017 (CGST Act) on grounds that the payment occurred after investigation began and alleged fraud and suppression.

Apollo Tyres, represented by Senior Counsel Joseph Kodianthana for Vikram Veerasamy, submitted that the petitioner had considered the TTF supply as ‘composite in nature’ and made the higher payment to buy peace and avoid further legal action, but the Revenue proceeded to pass the impugned order despite the ingredients of Section 74 not being fulfilled. The counsel referred to the decision of the Telangana High Court in Rays Power Infra Private Limited vs. Superintendent of Central Tax (2024) to support their position.

Additional Solicitor General, AR.L.Sundaresan submitted that the petitioner inserted tubes and flaps inside the tyre and wrapped it together and supplied it to the manufacturers as a “composite supply”. It was further submitted that the shortage amount was remitted by the petitioner subsequent to the investigation of DGGI and so, the bar of Section 39(9) would come into force.

Justice Krishnan Ramasamy observed that Section 74 applies only where non-payment or short payment of tax is due to fraud, wilful misstatement, or suppression of facts. Since Apollo Tyres had voluntarily disclosed its intent to pay the higher tax before the DGGI investigation and there was no evidence of deliberate evasion, the invocation of Section 74 was “without jurisdiction.”

The Court further held that mere delay in remitting tax, when coupled with voluntary disclosure cannot amount to fraud. At the worst, the same could be considered as tax not paid or short paid due to confusion in the entire industry and that the petitioner deferred the payment of tax and paid the same once the doubts had been cleared.

Also Read:Challenge to ITC Reversal not Entertained under Article 226: Madras HC Declines Interference with GST Order Confirming Demand [Read Order]

Also Read:Challenge to ITC Reversal not Entertained under Article 226: Madras HC Declines Interference with GST Order Confirming Demand [Read Order]

It was further held that any short payment arising from confusion in classification falls within the scope of Section 73, not Section 74. Consequently, the show cause notice, order-in-original dated 27 April 2023, and appellate order dated 18 March 2024 were set aside.

The Madras High Court however left open the larger question of whether the supply of tyres, tubes, and flaps constitutes a “composite” or “individual” supply to be decided in any appropriate case.