Begin typing your search above and press return to search.

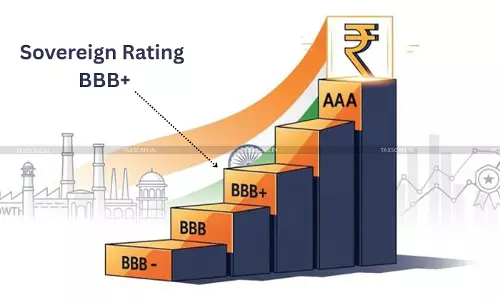

R&I Japan raises India’s Sovereign Rating to BBB+: Signals Strong Macroeconomic Conditions & GST Reforms

The Rating and Investment Information, Inc., Japan (R&I) recently raised India’s long-term foreign-currency sovereign issuer rating from BBB to...

![Finance Ministry notifies Harmonized Master List of Infrastructure Sub-sectors [Read Notification] Finance Ministry notifies Harmonized Master List of Infrastructure Sub-sectors [Read Notification]](https://images.taxscan.in/h-upload/2025/09/20/250x150_2089081-finance-ministry-harmonized-master-list-infrastructure-sub-sectors-taxscan.webp)

![SEBI Introduces ‘TLH’ Code for Smooth Transmission of Securities from Nominee to Legal Heir in CBDT Reporting [Read Circular] SEBI Introduces ‘TLH’ Code for Smooth Transmission of Securities from Nominee to Legal Heir in CBDT Reporting [Read Circular]](https://images.taxscan.in/h-upload/2025/09/20/250x150_2089079-sebi-introduces-cbdt-tlh-code-taxscan.webp)

![Sole Reliance on Retracted and Untested Statements Impermissible: CESTAT Sets Aside Penalty on Diamond Broker in Overvaluation Case [Read Order] Sole Reliance on Retracted and Untested Statements Impermissible: CESTAT Sets Aside Penalty on Diamond Broker in Overvaluation Case [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/250x150_2089042-sole-reliance-statements-impermissible-cestat-taxscan.webp)

![Disallowance of ₹2.26 Lakh Bonus as Dividend Due to Audit Report Error: ITAT Deletes Addition Based on CA’s Certificate [Read Order] Disallowance of ₹2.26 Lakh Bonus as Dividend Due to Audit Report Error: ITAT Deletes Addition Based on CA’s Certificate [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/250x150_2089029-audit-report-error-taxscan.webp)

![Loans from Sister Concern Treated as Deemed Dividend u/s 2(22)(e): ITAT Deletes Addition, Treating It as Business Current Account with Interest Repayment [Read Order] Loans from Sister Concern Treated as Deemed Dividend u/s 2(22)(e): ITAT Deletes Addition, Treating It as Business Current Account with Interest Repayment [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/500x300_2089037-itat-ahmedabad-loans-interest-repayment-taxscan.webp)

![ITAT Deletes ₹10.42 Lakh Addition u/s 69A as Cash Deposits during Demonetization Explained by Withdrawals [Read Order] ITAT Deletes ₹10.42 Lakh Addition u/s 69A as Cash Deposits during Demonetization Explained by Withdrawals [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/500x300_2089036-itat-cash-deposits-withdrawals-taxscan.webp)

![Disallowance of ₹16.28 Lakh Bogus Purchase without Rejection of Books: ITAT Restricts Addition to ₹1.29 Lakh Applying GP Rate [Read Order] Disallowance of ₹16.28 Lakh Bogus Purchase without Rejection of Books: ITAT Restricts Addition to ₹1.29 Lakh Applying GP Rate [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/500x300_2089034-disallowance-bogus-purchase-itat-restricts-addition-taxscan.webp)

![Income Tax Penalty Cannot Be Levied on Estimated Additions for Alleged Bogus Purchases: Bombay HC [Read Order] Income Tax Penalty Cannot Be Levied on Estimated Additions for Alleged Bogus Purchases: Bombay HC [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/500x300_2089066-income-tax-pently-bogus-purchases-sales-taxscan.webp)

![Disallowance of Rs.10.28 Lakh Interest on Loan by Charitable Trust as Application of Income: ITAT Sets Aside CIT(A) Order [Read Order] Disallowance of Rs.10.28 Lakh Interest on Loan by Charitable Trust as Application of Income: ITAT Sets Aside CIT(A) Order [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/500x300_2089018-itat-delhi-trust-taxscan.webp)

![Win for Parle Products: Bombay HC Rules Freight Charges Reimbursed by Wholesalers Do Not Form Part of Sale Price, No Sales Tax Payable [Read Order] Win for Parle Products: Bombay HC Rules Freight Charges Reimbursed by Wholesalers Do Not Form Part of Sale Price, No Sales Tax Payable [Read Order]](https://images.taxscan.in/h-upload/2025/09/20/500x300_2089058-win-for-parle-products-parle-products-taxscan.webp)