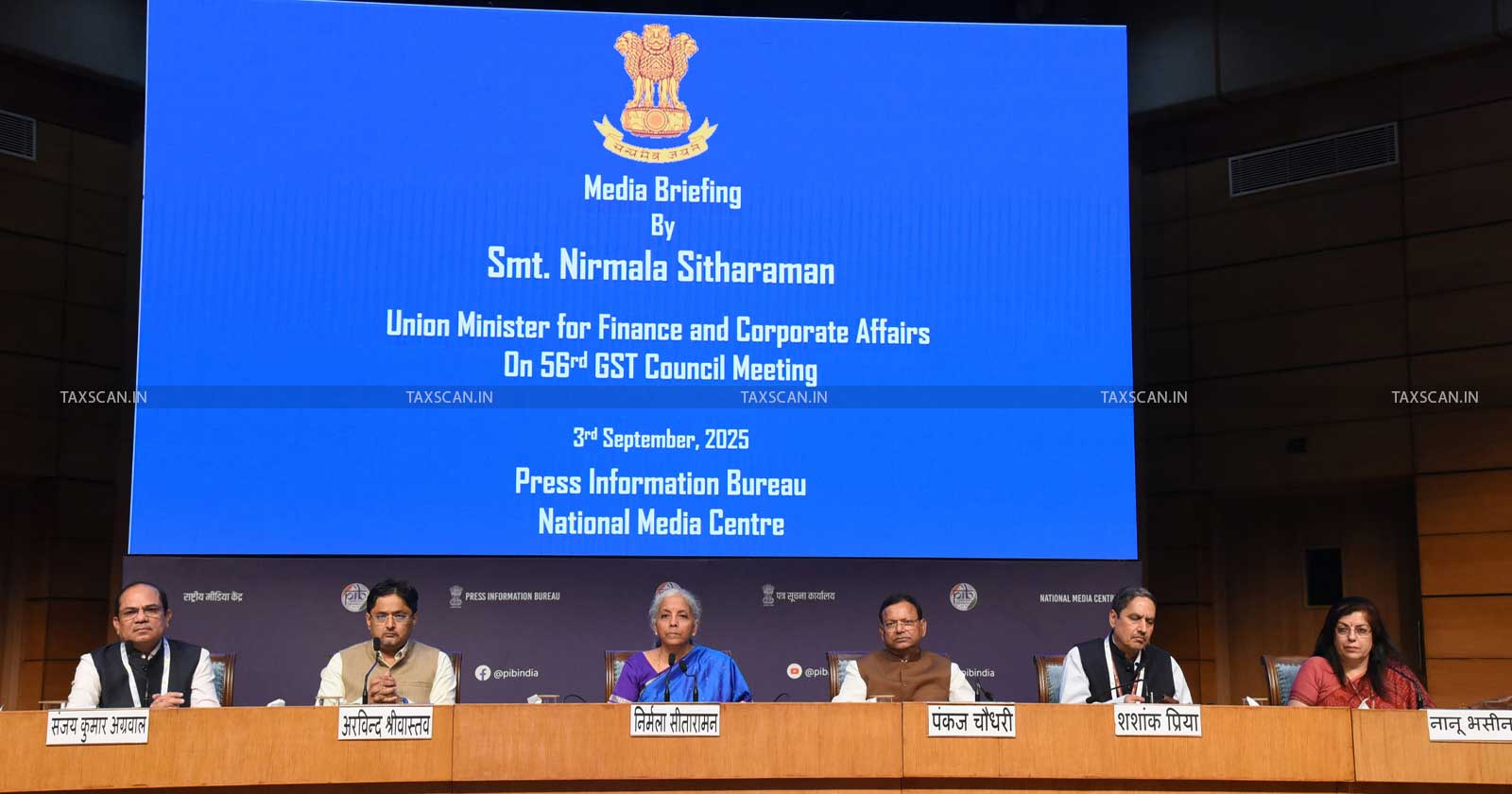

40 % Rate as Special Rate of GST by 56th GST Council Meet; Why?

A special 40% GST rate was imposed at the 56th GST Council meeting, mostly for luxury goods and so-called "sin goods."

The special rate is unique since it only applies to a limited number of specific goods, mostly luxury and sin goods. In addition to Goods and Services Tax (GST), the majority of these commodities were subject to Compensation Cess.

In order to maintain tax incidence on the majority of items, the Compensation Cess rate is being combined with GST as the Compensation Cess levy has been determined to be discontinued. Since other goods and services were already subject to the highest GST rate of 28%, a special rate has been applied to them.

Know the complete aspects of tax implications of succession, Click here

A special 40% GST rate was imposed at the 56th GST Council meeting, mostly for luxury goods and so-called "sin goods." This new rate is an important component of a broader tax system simplification overhaul.

"Sin goods" are things that are deemed detrimental to society or health. There are two reasons for the high tax rate. By making these commodities much more expensive, the government hopes to reduce their use, which is believed to promote public health and welfare.

Because of their "inelastic demand," consumers will continue to purchase these goods - especially those who are hooked on them, regardless of any increase in the prices. This high rate of tax on the “sin-goods” ensures a steady and constant stream of revenue for the government.

Complete Ready to Use PDFs of 200+ Agreements Click here

A variety of goods that were formerly subject to 28% tax plus a compensation cess are now subject to the 40% rate, which raises the overall tax incidence to a comparable level. For the majority of these commodities, the two-part tax structure is replaced with the single, unified 40% GST rate.

This special 40% pricing applies to the following items and services: tobacco products, such as cigars, cigarettes, chewing tobacco, gutka and pan masala. Also facing the tax levy are carbonated drinks, fruit-based carbonated drinks and caffeinated drinks which are examples of sugary and aerated beverages.

Motorcycles with engines larger than 350 cc, as well as large automobiles and SUVs with engines larger than 1,200 cc for gasoline and 1,500 cc for diesel. Personal use planes, yachts, and specific betting and gaming services.

Step by Step Handbook for Filing GST Appeals Click here

The Central GST Act, 2017 was amended to provide for a higher tax rate ceiling by the Central Goods and Services Tax (Amendment) Act, 2018, which was approved by Parliament. In particular, Section 9 of the CGST Act which addresses tax levy was amended by the change. The CGST maximum rate under the original act was 20%. The change from 2018 raised this cap to 40%.

This amendment was intended to give the government the legal foundation and latitude to raise the tax rate on specific luxury and demerit items in the future, if necessary, without the need for a new amendment. This was a proactive measure in order to bring the law in line with prospective future policy changes like the new 40% rate on "sin goods" that was considered at the 56th GST Council meeting. The previous system of 28% GST plus a compensatory cess on certain products has been replaced by the new 40% rate, which is a consolidated rate.

Support our journalism by subscribing to Taxscanpremium. Follow us on Telegram for quick updates