56 th GST Council Meet Reduces GST rate on Vehicles Supplied as Ambulances from 28 % to 18 %

Vehicles that are approved as ambulances from the factory and equipped with the required equipment are subject to the new charge.

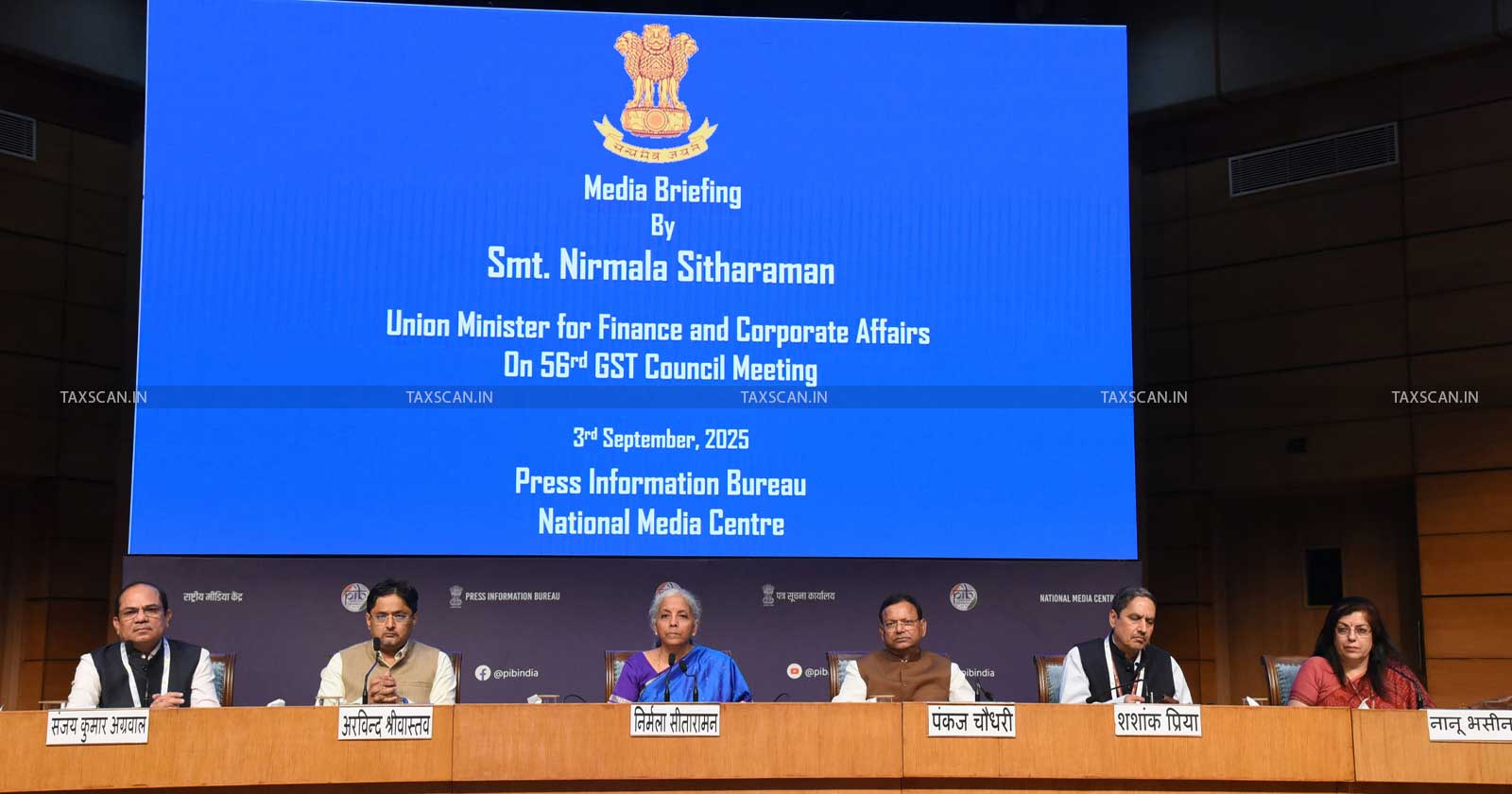

A drop in the GST rate from 28% to 18% for vehicles supplied as ambulances was authorized during the 56th GST Council meeting, which was presided over by Finance Minister Nirmala Sitharaman.

Towards a two-tier system of 5% and 18%, with a 40% rate on demerit items, this move was a part of a larger attempt to rationalize GST rates and streamline the tax structure.

The GST rate on vehicles supplied as ambulances has been lowered from 28% to 18% as part of a larger effort to rationalize the GST. The purchase price of ambulances for hospitals and ambulance service providers is anticipated to drop as a result of the reduced GST rate. Supporting the healthcare mobility industry and increasing access to necessary medical transportation are the goals of this initiative.

All-in-One Manual with Updated GST Laws & Provisions, Click here

This adjustment is a component of a broader reform that aims to streamline the tax structure for a variety of vehicles, including as lorries, buses, and three-wheelers, which also experienced a decrease in their GST rates. This reduction is supposed to help the healthcare transportation industry and bring down the cost of purchasing ambulances. Vehicles that are approved as ambulances from the factory and equipped with the required equipment are subject to the new charge.

The rate of GST on all medical devices, instruments, and apparatus used for surgical, dental, and veterinary purposes was lowered to 5% with a goal to reduce healthcare costs for people, especially those who are less fortunate.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates