The Goods and Service Tax Networks (GSTN) has rolled out functionality to drag the data of Import ITC (from Custom website) which is not reflected on the GST Portal.

Many taxpayers are facing technical issues on the GST Portal that Import ITC of some Bill of Entries is not getting reflected in GSTR 2A/2B. Due to this many taxpayers are receiving notices from the department for excess claims of ITC.

How to view BoE (Bill of Entry) on the GST Portal?

To view the details of BoE (Bill of Entry) on the GST Portal, perform the following steps:

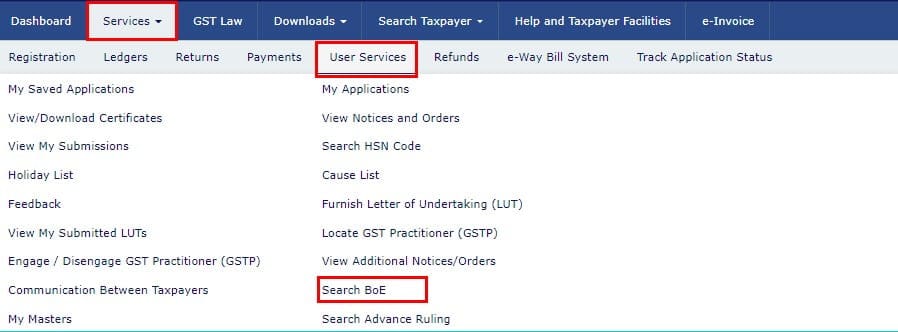

Step 1: Access the www.gst.gov.in URL. The GST Home page is displayed. Click the Services > User Services > Search BoE option.

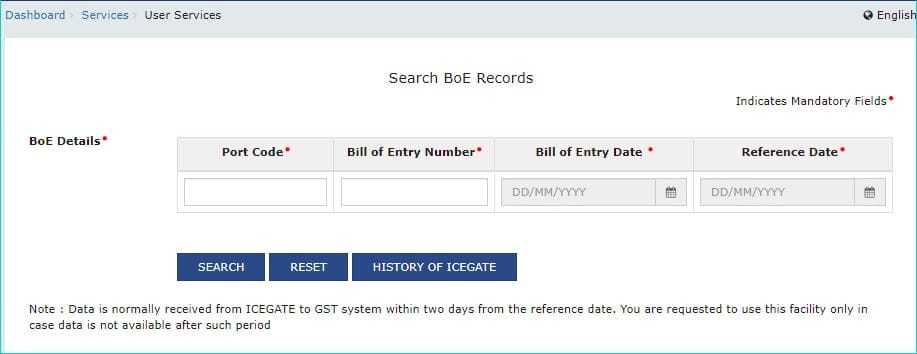

Step 2: Search BoE Records page is displayed.

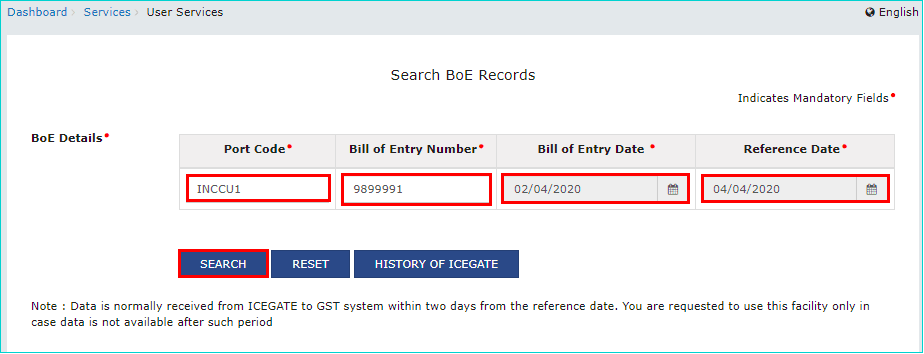

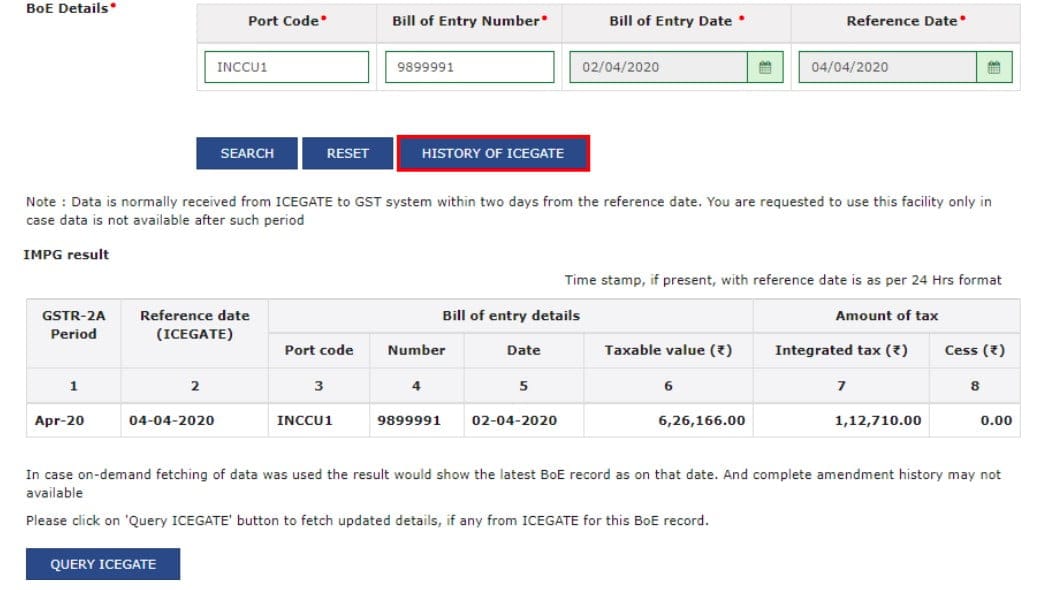

Step 3: Enter the Port Code, Bill of Entry Number, Bill of Entry Date, and Reference Date. Click the SEARCH button.

It is noteworthy that the reference date is the date when the goods have been cleared from Customs (Passed out of Customs charge). The reference date will either be Out of charge date, Duty payment date, or amendment date – whichever is later.

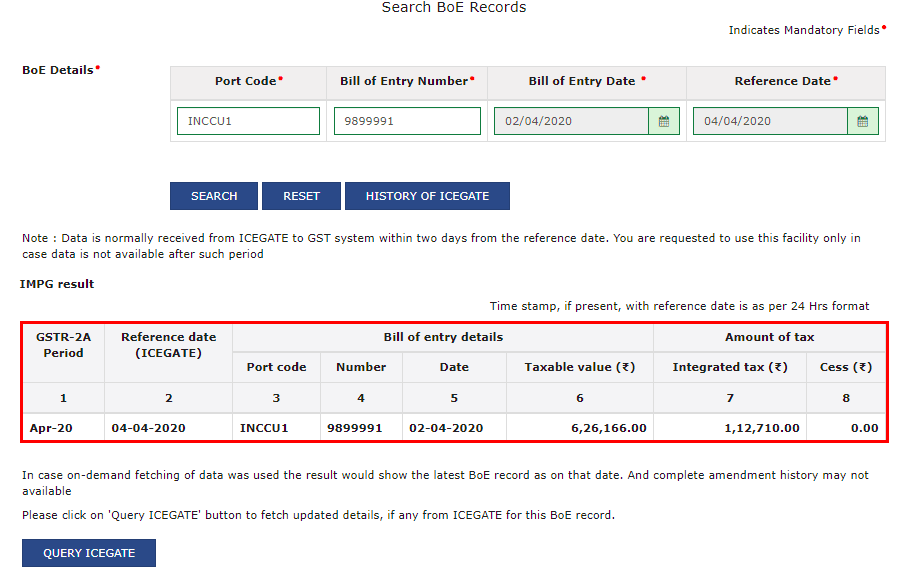

Step 4: The search results are displayed. You can click on the QUERY ICEGATE button to initiate on-demand fetching of the latest BoE record from ICEGATE, in case, most recent record is not available with the GST Portal. You can click the RESET button to reset the data entered in the fields.

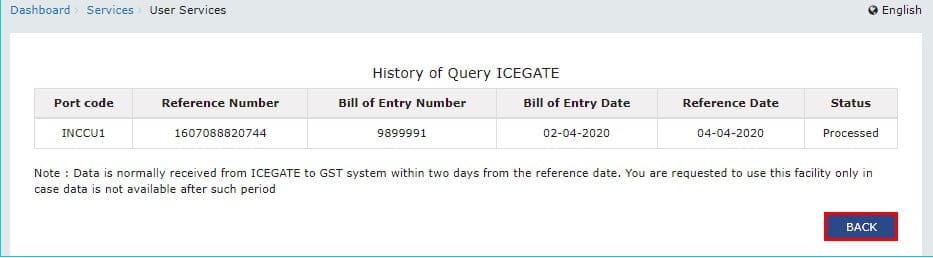

You can click HISTORY OF ICEGATE to view the History of query ICEGATE.

History of fetched BOE details from ICEGATE along with the status of the query is displayed. You can click the BACK button to go back to the Search BoE Records page.

The Kerala High Court while showing discontent to the Centre said that the Pandemic is not an excuse for the Non-Inclusion of Petroleum products under GST.

The petitioner, Kerala Pradesh Gandhi Darshanvedhi contended that the non-inclusion of petrol and diesel under the GST regime is violative of Articles 14 and 21 of the Constitution of India.

The counsel for the Central Board of Indirect Taxes and Customs (CBDT), PR Sreejith handed over a copy of the letter from the Director of GST Council to submit that petroleum

Once the representation submitted by the petitioner was considered by the GST council at its 45th meeting, it decided that it is not appropriate to include petrol and diesel within the ambit of GST at this stage. This was then vehemently opposed by the petitioner who once again moved the Court by way of the present plea.

After perusing the statement filed on behalf of the Director of Goods and Services Tax Council, the bench observed, “Even though the matter was taken in the 45th GST Council meeting, three issues seemed to have been considered by the Council for bringing the petroleum products under the GST regime, i.e., (i) the matter involves high revenue implications, (ii) requires larger deliberations and (iii) during pandemic times, it would be difficult to bring petroleum products under the GST regime.”

The court observed, “We are not satisfied with the reasons. There should be some discussion and genuine reasons as to why petroleum products cannot be brought under the GST regime. Further, the pandemic period cannot be cited as a reason. It is well known that even during the pandemic, several decisions were taken involving revenue, after deliberations.”

The Court made the observation while hearing a PIL filed through Advocate Arun B Varghese, which stated that the recent hike in petrol and diesel prices has wreaked havoc, on general economic stability and the lives of the common man, especially those from lower-income households.

Subscribe Taxscan Premium to view the JudgmentSupport our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.

The Director-General of Foreign Trade (DGFT) issued the Trade Notice in respect of the Electronic filing of Registration Cum Membership Certificate (RCMC) or Registration Certificate (RC) through Common Digital Platform with effect from December 06, 2021.

A new online common digital platform for the issuance of Registration Cum Membership Certificate (RCMC)/ Registration Certificate (RC) has been developed which would be a single point of access for all exporters/importers and Issuing agencies. The given platform shall be available at https://dgft.gov.in.

The objective of the platform is to provide an electronic, contact-less single window for the RCMC/RC-related processes including Application for Fresh/ Amendment/ Renewal of RCMC/ RC. Applications for RCMC/ RC may be submitted through the common platform w.e.f. December 06, 2021. Submitting applications on this online platform shall not be mandatory for the exporters in the immediate and there shall be a transition period for issuing agencies as well as Exporters to onboard this common digital platform. The existing procedure of submitting applications directly to the designated issuing agency shall also be in operation in parallel during this transition period. Submission and issuance of RCMC/ RC by the issuing agencies through their system may continue up to February 28, 2022, or until further orders.

The authenticity of the online issue shall be verifiable by login into the exporter profile on https://dgft.gov.in. The details for RCMC/ RC issued using the DGFT portal will be reflected instantly in the profile of the exporter. The concerned Indian Exporters with regard to the process being notified namely Digital Signature Certificate (DSC)/ Aadhar would be required for the purpose of electronic submission of applications. The digital signature would be the same as used in other DGFT applications, and no separate registration is required for availing of the RCMC/ RC service from the DGFT Portal. Already registered exporters/importers can avail of the service using the same login credentials.

Subscribe Taxscan Premium to view the JudgmentSupport our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.

The Calcutta High Court deleted the disallowance on account of Slump Sale of Chemical Undertaking.

The revenue has challenged the Income Tax Appellate Tribunal has erred in law in deleting the disallowance of the sum of Rs.3.50 Crores and Rs.2.11 Crores for the assessment year 2006-07 and 2007-08 respectively on account of slump sale of chemical undertaking under Section 50B of the Income Tax Act, 1961 by relying on its own decision for the assessment year 1994-95 which has not been accepted by the revenue and the appeal has been filed before this Court which is pending adjudication.

The appellant revenue has challenged the order of the Tribunal by contending that the Tribunal ought not to have followed the decision in the assessee’s own case for the assessment year 1994-95. Senior Counsel appearing for the respondent-assessee submitted that the order passed by the Tribunal in the assessee’s own case for the assessment year 1994-95 has been upheld by the Hon’ble Division Bench of this Court in the case of Commissioner of Income Tax, Kolkata-IV Vs. AKZO Noble India Ltd. There is nothing on record to show whether the said decision has been reversed or modified. Therefore, the issue stands concluded in favor of the assessee.

The division bench of Justice T.S. Sivagnanam and Justice Hiranmay Bhattacharyya noted that the concept of slump sale was discussed in CIT v. Mugneeram Bangur & Co. At this stage, it is quite important to appreciate the ratio of CIT v. Artex Manufacturing Co. The written down value of the plant, machinery, and deadstock according to the assessee’s books was Rs. 4,36,896/-. The undertaking was sold on a valuation of these items as Rs. 15,87,296/-. According to the department, the written down value was Rs. 3,32,276/-. The difference between them was the bone of contention in this case. Whether it would be taxed as capital gains or under the head “business”. The Supreme Court ruled that if the value of the individual assets could not be determined, then the value of all the assets together should be taken. In that case, the profit or gain made would be taxed as a capital gain. In other cases, it would be taxed as business income. The entire matter was referred to the tribunal for a decision. In that decision the Income Tax Act, 1922 was under consideration.

Subscribe Taxscan Premium to view the JudgmentSupport our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.

The Institute of Chartered Accountants of India (ICAI) found 17 Chartered Accountants (CA) Guilty of Professional Misconduct.

The Institute of Chartered Accountants of India (ICAI) Disciplinary Committee finds 17 Chartered Accountants Guilty of Professional Misconduct namely CA Khem Chand Gandhi, CA Viren Lalitbhai Pateliya, CA Parag Vinodchandra Mehta, CA Shrikant Shankar Nironi, CA Siddharth Shyam Shetye, CA Anant Kankani, CA Ujjavalkumar Vallabhdas Chaniyara, CA Ronak Bhut, CA Ajay Agarwal, CA Maddala Galiswara Rao, CA Nitin Madhusudanji Mantri, CA Nikhilkumar Hasmukhbhai Jani, CA Ravi Agarwal, CA. Deba Prasad Misra, CA Vijay Kumar Sharma, CA Vikas Kumar Khaitan, and CA. Kotila Veetil Shankaran.

The ICAI notified the removal of the name of 17 CA from the register of members along with a fine.

The ICAI notified under Regulation 18 of the Chartered Accountants Regulations, 1988 that the name of CA. Khem Chand Gandhi shall stand removed from the Register of Members for a period of 01(One) month with effect from 26th November, 2021.

Further, the name of CA. Viren Lalitbhai Pateliya (Membership No. 163142)shall stand removed from the Register of Members for a period of 15 days with effect from 26th November, 2021.

The name of CA. Parag Vinodchandra Mehta (Membership No. 036867) shall stand removed from the Register of Members for a period of 3 months with effect from 26th November, 2021.

The name of CA. Shrikant Shankar Nironi (Membership No. 215563), shall stand removed from the Register of Members for a period of 03 months with effect from 26th November, 2021.

The name of said CA. Siddharth Shyam Shetye (Membership No. 116188), shall stand removed from the Register of Members for a period of 01 year with effect from 26th November, 2021.

Further, the name of CA. Anant Kankani (Membership No. 111603), shall stand removed from the Register of Members for a period of 05(five) years with effect from 26th November, 2021.

The name of said CA. Ujjavalkumar Vallabhdas Chaniyara (Membership No. 151776), shall stand removed from the Register of Members for a period of 02(Two) years with effect from 26th November, 2021.

The name of said CA. Ronak Bhut (Membership No. 149575), shall stand removed from the Register of Members for a period of 02(Two) years with effect from 26th November, 2021.

The name of CA. Ajay Agarwal (Membership No. 054233) shall stand removed from the Register of Members for a period of 02 months with effect from 26th November, 2021.

The name of said CA. Maddala Galiswara Rao (Membership No. 029893), shall stand removed from the Register of Members for a period of 02 months with effect from 26th November, 2021.

The name of said CA. Nitin Madhusudanji Mantri (Membership No. 132470), shall stand removed from the Register of Members for a period of 01 month with effect from 26th November, 2021.

The name of said CA. Nikhilkumar Hasmukhbhai Jani (Membership No. 124684), shall stand removed from the Register of Members for a period of 15 days with effect from 26th November, 2021.

The name of said CA. Ravi Agarwal (Membership No. 407938), shall stand removed from the Register of Members for a period of 01 year with effect from 26th November, 2021.

The name of CA. Deba Prasad Misra (Membership No. 062771), shall stand removed from the Register of Members for a consolidated period of 126) months [10 years plus additional 6 months] with effect from 26th November, 2021.

The name of said CA. Vijay Kumar Sharma (Membership No. 415357), shall stand removed from the Register of Members for a period of 06 months with effect from 26th November, 2021.

The name of said CA. Vikas Kumar Khaitan (Membership No. 063352), shall stand removed from the Register of Members for a period of 01 year with effect from 26th November, 2021.

the name of said CA. Kotila Veetil Shankaran (Membership No. 033960), shall stand removed for a consolidated period of 05 years plus additional 06 months from the Register of Members with effect from 26th November, 2021.

Subscribe Taxscan Premium to view the JudgmentSupport our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.

The Institute of Chartered Accountants of India (ICAI) has notified Important Announcement – Information System Audit – Assessment Test (ISA – AT), January 2022 will be held on Saturday, 8th January 2022 from 9 AM to 1 PM IST.

“Members are hereby informed that the next Information Systems Audit (ISA) Course Assessment Test (Old as well as New Syllabus) which is open to the members of the Institute will be held on 8th January 2022 (Saturday) from 9 AM to 1 PM (IST) at the following cities provided that the sufficient number of candidates offer themselves to appear there from,” the ICAI announced.

The ICAI notified the 78 Cities in 22 States where the examination shall be conducted.

The Council reserves the right to withdraw any centre at any stage without assigning any reason. The above Test is open only to the Members of the Institute who are already registered with the Institute for the ISA course and fulfill the eligibility criterion laid down. The fee payable for the above Assessment Test is Rs.2000/-.

An application for admission to the Information Systems Audit (ISA) Course – Assessment Test is required to apply online at isaat.icaiexam.icai.org from 26th November 2021 to 10th December 2021 and remit the examination fee of Rs.2000/- online by using VISA or MASTER or MAESTRO Credit / Debit Card / Rupay Card / Net Banking / Bhim UPI.

For more details Click here.

Four and half years ago, the Indian Government brought GST to reality and implemented it countrywide with effect from 1 July 2017. Discernably, it was a historic moment for the country and was welcomed with a lot of hullabaloos. The flyers of GST were widely distributed which explained the prominent features of the scheme such as seamless credit, single tax, easy to understand and implement, and a completely automated compliance system.

While this automated compliance system sounded impressive, the actual execution and implementation of this system were sloppy. The technology and GSTN portal were plagued with numerous issues. Right from logging on the portal, to missing data to a slow and sluggish portal, the taxpayers were exasperated, unsure of how to deal with such a solution. To address the issue at hand, the Government came up with a simplified return system that involved 2 returns to be filed each month viz. GSTR-1 and GSTR-3B as against the original plan of GSTR-1, GSTR-2, and GSTR-3. Albeit GSTR-3B was termed as the ‘stop-gap’ arrangement, it has now become the permanent return and all other return systems have been scrapped. Thus, undoubtedly, the onset of GST and its compliance system was full of design bugs which gave sleepless nights to the taxpayers.

In this article, we wish to discuss a case law from the era when the GSTN portal was going through testing times. The case of Union of India Vs Bharti Airtel Ltd. & Ors (Supreme Court of India) [CIVIL APPEAL NO. OF 2021 (ARISING OUT OF S.L.P. (C) NO. 8654 OF 2020) dated October 28, 2021], was decided by the Hon’ble Supreme Court (SC) and a scandalous judgment was pronounced recently.

Facts and decision

Bharti Airtel or the assessee had underreported and under claimed Input Tax Credit (ITC) in GSTR-3B form for the period of three months viz. July 2017 to September 2017 due to lack of generation of GSTR-2 and GSTR-3 (the statutory forms as prescribed at that point in time). The Company contended that because GSTR-2 could not be generated, it was unable to validate the ITC claim, and hence the error of under-claiming ITC was committed. The ITC under question amounts to a whooping INR 923 crores and hence the stakes involved were significant. Bharti Airtel wished to claim a refund of INR 923 crores paid in excess during the said period.

A question that could arise here is – what is the need of claiming a refund if it can be adjusted against the output tax liability in the subsequent period. The telecom sector has faced a reduction in tariff over the years and the accumulated credit would not be consumed against the reduced output liability in all probabilities. Hence, the refund claim is the only solution to recoup the excess tax paid. A petition was filed before the Delhi High Court (HC) for allowing the said refund claim. The Delhi HC held that rectification of the return of a specific month to which the error pertains to is imperative and accordingly read down para 4 of the Circular No. 26/26/2017-GST dated 29 December 2017, to the extent that it restricts the rectification of Form GSTR-3B in respect of the period in which the error has occurred. The HC, therefore, allowed the petitioner to rectify respective returns and directed the authorities to verify the ITC claim within two weeks and give the effect of the same.

Understandably so, the revenue approached the SC challenging the refund order of the Delhi HC which was admitted. The SC recently heard the petition and set aside Delhi HC’s order stating that an assessee cannot be permitted to unilaterally carry out rectification of his returns submitted electronically in Form GSTR3B, which inevitably would affect the obligations and liabilities of other stakeholders, because of the cascading effect in their electronic records. Inter-alia its other observations, the SC held the following:

Our views

The SC’s observation that the primary source of self-assessment should be the books of accounts and records is not completely incorrect. This is how the liability and the ITC claim were determined in the previous regimes. There were no inward statements to intimate an assessee the ITC that he/she should claim. However, the point here is that GST has such mechanics. The introduction of GSTR 2 or the advent of GSTR 2A has been a differentiator as far as the GST regime is concerned. While the SC has invalidated the reliance of the taxpayer on GSTR-2A, the Government has introduced Section 16(2)(aa) which legally disallows any credit availed in excess of what is populated in GSTR 2A/2B. Therefore, while the judiciary is cornering with the revenue, the revenue itself is contradicting the judiciary.

Moreover, if GSTR-2A cannot be a primary source of determining the ITC, what is it exactly meant for? Because the ITC can be determined basis the books of accounts, therefore, GSTR-2A becomes a redundant statement. Being redundant, the same cannot be used to block credits by the officers under rule 86A of CGST Rules, 2017. The SC termed GSTN portal to be a facilitator. The dictionary defines facilitator as something which makes a process easy or easier. The GSTN portal is the mandatory platform to file returns and not something which is voluntary to make the return filing process easy.

Currently, what we are practically experiencing is something entirely different. Not only the revenue is considering GSTR-2A as a statement, but it is also now treating it as a bible for allowing ITC to taxpayers. Notices are being issued to taxpayers left, right, and center on mismatches between ITC as per GSTR-2A vs GSTR-3B; ITC is being blocked if the same is not reflected in GSTR-2A; and Rule 36(4) of CGST Rules, 2017 which is the current enabler to avail credit is wholly dependent on credit reflected in GSTR-2A. Therefore, in which part of the world is GSTR-2A being considered as a secondary source to determine credit is something which is beyond our understanding.

While the Hon’ble SC mentioned that self-assessment is a regime which is being carried forward from the previous regime, and the taxpayers should have been prepared for the same under GST as well, it forgot to note that in the previous regime, Bharti Airtel would have been permitted to rectify its return. There was absolutely no bar to rectify the returns to correct the errors discovered later.

Moreover, under GST, a circular was issued on 1 September 2017 which permitted the taxpayers to rectify errors committed while filing GSTR-3B by way of rectifications in GSTR-1 and GSTR-2 of the same month. However, at a later point in December 2017, the same circular was kept in abeyance on the premises that GSTR-2 and GSTR-3 were non-operational. Therefore, it is important to note that for the period September to December, a taxpayer would be under a belief that returns can be rectified and hence, on the cautious side paid excess tax. However, in December the taxpayers were given a jolt when the circular was kept in abeyance. It is evident that the taxpayers were promised functionality to rectify returns but the promise was a hollow one and was never fulfilled. In such circumstances, how can the court hold the taxpayer to be at a fault is non-fathomable.

This is a case of a refund of excess tax paid. Therefore, clearly, the revenue is at an advantage. However, the question of equity is whether the SC would have pronounced a similar judgment if Bharti Airtel had a short-paid tax on account of the non-functioning of GST portal? The answer is a deafening no. Bharti Airtel would have to pay interest and most probably penalty as well in such a case.

Absolutely Yes! Once the doors to rectify returns are opened, it shall be a complete commotion, the capability to handle which is not with the revenue. Moreover, had the SC pronounced this judgment in favor of the assessee, the floodgates to similar litigations would have opened. However, such situations only arise when the administration is not completely thorough; when the law says something and completely different scenarios is prevalent practically.

As for the obligations and liabilities of the stakeholders, which the SC mentioned in their judgment, the taxes were paid by the suppliers. Bharti Airtel failed to avail credit of the same. The only other stakeholder that is left in the equation is the revenue who would have to cough up the excess tax collected.

Way forward

As has been discussed on various platforms, this decision might have turned in the favor of the revenue, for now, however, the noting of the SC will prove to be against the revenue in the long term. By calling the GST portal as a ‘facilitator’ which cannot be the primary source of information, the SC has given an avenue to all taxpayers litigating notices on Rule 86A or Section 16(4) or mismatch of ITC.

GSTN portal is the backbone of the GST regime; it cannot be termed as a mere facilitator. The entire scheme and its execution are oscillating on the GSTN portal. A review petition against this decision may be filed by the assessee; however, a favorable decision is difficult to expect.

[The authors are Jigar Doshi- Founding partner at TMSL and Nikita Maheshwari- Manager at TMSL. They can be reached at jigar.doshi@tmsl.in]

The Institute of Chartered Accountants of India (ICAI) released the Admit Cards for the December 2021 Exams.

The candidates may refer to specimen copies and the answer book link is given in your Hall ticket at the end it has some changes.

“Admit cards in respect of candidates admitted to the Foundation, Intermediate (IPC), Intermediate, Final and Final-New examination, with their photographs and signatures on them, are hosted on https://icaiexam.icai.org/ No physical admit cards will be sent to any candidate. Candidates are required to download and print their admit cards from the website,” the institute said.

In order to download the admit card, the candidates must go to icaiexam.icai.org, then click on the login window, Enter login ID (registration number) and password and then Submit.

On the next page, click on the link to download the admit card Candidates must carry their admit cards on the exam day. If the appearing candidate is a minor, he/she will have to carry an undertaking signed by parents or guardians. Students will be allowed to enter the exam center from 1 pm onwards and to maintain social distance students who complete their exam by 4 pm will be allowed to leave the exam center. As per the instructions issued by the ICAI candidates should bring their personal water bottles, they can also carry a small transparent bottle of hand sanitiser to be used during the examination.

Based upon specific intelligence, the officers of the Anti Evasion branch of Central Goods and Service Tax (CGST) Commissionerate, Delhi (East) have unearthed a case of availment/utilization and passing on of inadmissible input tax credit (ITC) through bogus GST invoices without actual movement of goods of Rs 34 crore (approx).

The 7 firms were created in order to generate bogus GST invoices with an intent to pass on fraudulent ITC without actual movement of goods and without paying actual GST to the Government. These entities have generated goods less GST invoices of value Rs. 220 crore (approx.) and passed inadmissible ITC amounting to Rs. 34 crore (approx.). Sh. Rishabh Jain was the mastermind behind running this racket of creating bogus firms and generating/selling bogus GST invoices.

The modus operandi involved creating multiple firms with the intent to avail/utilize & passing on of inadmissible credit. The firms involved in this network are M/s Blue Ocean, M/s Highjack Marketing, M/s Kannha Enterprises, M/s S S Traders, M/s Evernest Enterprises, M/s Gyan Overseas & M/s Viharsh Exporters Pvt. Ltd.

Sh. Rishabh Jain tendered his voluntary statement admitting his guilt. He admitted that due to non-payment against the Overdraft account of the Central Bank of India, the business premises were sealed by bankers. Thereafter, he indulged in the issuance of bogus GST invoices without actual movement of goods.

Sh. Rishabh Jain has knowingly committed offences under Section 132(1)(b) of the CGST Act, 2017 which is cognizable and non-bailable offences as per the provisions of Section 132(5) and are punishable under clause (i) of the subsection (1) of Section 132 of the Act ibid. Accordingly, Sh. Rishabh Jain has been arrested under Section 132 of the CGST Act on 13.11.2021 and remanded to judicial custody by the duty Metropolitan Magistrate till 26.11.2021. Further investigations are in progress.

Dear Registrant,

Thank you for Registering for the Webinar. Kindly see the Joining details of the Webinar Below.

When: Nov 08, 2021 04:00 PM India

*Please click the link below to join the webinar:*

*Webinar ID: 820 0236 9135*

*Passcode: 2021*

Also Watch here- https://www.taxscan.in/live-from-4-pm-webinar-how-to-deal-with-issues-on-input-tax-credit/133313/

For Queries – 8848 774 171, 9037 288 697, info@taxscan.in

P.S. *_Zoom Link and Taxscan URL will be open from 3.30PM onwards_*.

The Ministry of Corporate Affairs (MCA) has notified that the Director Identification Numbers (DINs) of Directors found to be disqualified post-demonetization has been deflagged since the restriction was for five years.

“Ministry of Corporate Affairs had flagged the DINs of Directors found to be disqualified under subsection 2(a) of section 164 of the Companies Act, 2013 w.e.f. 1st November 2016 for a period of five years. This is for the information of all the concerned that DINs eligible to be de-flagged on expiry of the period of disqualification are in the process of verification. Necessary action shall be taken shortly,” the Ministry said.

The Ministry deactivated around 19 lakhs (19,40,313) Director Identification Numbers in the MCA21 Database due to non-filing of Know Your Client (KYC), as of 28.11.2019.

As per records, the MCA21 Database does not contain information regarding the employment details of directors / DIN holders. The terms “Ghost Directors” and “Shell Companies” are not defined in the Companies Act, 2013. However, during the Financial Year 2017-18 and 2018-19, Registrar of Companies (ROCs) had struck off 3,38,963 companies u/s 248 of the Companies Act, 2013 for failing to file Financial Statements or Annual Returns and the total number of 4,24,454 directors were disqualified under the provisions of section 164(2)(a) read with Section 167(1) of the Companies Act, 2013.

The Punjab Chief Minister Charanjit Singh Chinni on Wednesday announced to scrap 40,000 pending cases of value-added tax (VAT), out of the total 48,000 cases related to the financial years 2014-15, 2015-16 and 2016-17, against traders and industrialists across the state.

He was addressing industrialists, traders and prospective entrepreneurs on the second day of 4th Progressive Punjab Investors Summit on the theme of ‘A story of Partnership, Delivery & Growth: Investors Reassured’ in Ludhiana, the CM said 8,000 remaining cases will be settled amicably by asking the traders/ industrialists concerned to deposit only 30% of the total outstanding tax liability, thus saving them from a lot of inconvenience caused to them on this count. Another long-pending demand of the industry to abolish institutional tax, which has been implemented since 2011, was also catered to by the CM.

Reiterating his government’s firm commitment to create a conducive ecosystem for the ease of doing business in the state, CM Channi assured the industry of fulsome support to make Punjab the frontrunner state not within the country but across the globe.

Listing the major initiatives to repose confidence among the industrialists and traders to give further impetus to industrial growth, CM Channi said the Punjab government has already okayed several pro-investor initiatives and concessions to boost trade and industry in the state.

He added that the state government has allowed faceless assessment of GST and VAT due to which the traders and industrialists now need not to present themselves physically before the taxation officers anymore.

Finance minister Manpreet Singh Badal said the state government has allowed faceless assessment of GST and VAT due to which the traders and industrialists need not to present themselves physically before the taxation officers anymore.

Channi further said that the mobile squad earlier comprising 14 persons has also been reduced to only four in the taxation department in an effort to put an end to “inspector raj”.

Channi further said that to boost economic activity in the border districts of the state, the Punjab government will acquire requisite land for Patti-Makhu rail link and hand it over to the Ministry of Railways before ensuing budget.

The Tamil Nadu Government has issued the instruction in respect of Standard Operating Procedure for Faceless Refund.

During the meeting with the Joint Commissioners (Territorial) on the introduction of faceless refund, they have brought to notice some issues which have cropped up while the circular issued in the reference cited on the procedure for faceless refund implemented from 4th October 2027.

In order to address those issues and to implement the faceless refund in a smooth and hassle-free manner, the following instructions are issued as addendum to the procedure for faceless refund, In para 4.2 of the circular cited, in Scenario-3 it has been stated that “Even in the case of acceptance of rejection by the taxpayer, PO-1 shall recommend for personal hearing.” This is modified as “When the taxpayer has given acceptance of rejection of refund amount claimed in writing to the PO-1, it tantamounts to adhering to the principle of having heard the taxpayer since the taxpayer had already been put on notice for rejection of refund amount with reasons by the PO-1 and his acceptance of such rejection was given in writing. In these cases, PO-1 himself will issue orders and shall not transfer tasks to PO-2. This has been brought into production with effect from 27-10-2021. Further, the PO-1 is responsible for the issue of refund where refund is fully allowed, partially allowed and accepted by the taxpayer and fully disallowed but accepted by the taxpayer and hence the transfer of task to PO-2 shall be decided by the PO-1 based on the circumstances of the facts of the case.”

Time-line for issue of refund relating to zero rated supply and refund relating to other than zero rated supply is enclosed for strict adherence of total time limit of 60 days from the date of recipient of application for refund as provided in section 54(7) of the TNGST Act, 20l7.

“The JCs territorial are requested to issue suitable instructions to their proper officer to implement the faceless refund pilot module successfully without any hindrance to the taxpayer,” the circular said.

Subscribe Taxscan Premium to view the JudgmentSupport our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.

Income tax deductions help individuals lower their taxable income and ultimately reduce their tax liability in a given financial year. Put simply, income tax deductions are investments made during a financial year that are offset against the gross annual income when filing income tax return.

The provision of tax deductions is put in place to inculcate a habit of saving in people to help them build a secure financial future.

The most popular examples of income tax deductions include investments made under Section 80 of the Income Tax Act, 1961, in ELSS funds, principal repayment of home loan, Public Provident Fund (PPF), National Pension Scheme (NPS), etc.

One can avail up to Rs. 5,000 on preventive check-up for self, dependent children, spouse or parents below 60 years of age under Section 80D. For parents 60 years or above, Rs. 7,000 can be claimed.

If your parents aged 60 years or above are not covered under a medical insurance policy, you can still claim deduction on the money spent on their medical bills.

Section 80D allows for the deduction for money spent on maintaining your health and health insurance, and assumes great significance in your tax planning and personal finance. Individual and Hindu Undivided Family (HUF) can claim deduction from taxable income under Section 80D. A person can claim a deduction for the health insurance premium and expense incurred towards preventive health checkup for self, spouse, dependent children and parents. This is-subject to the terms and conditions mentioned in the Section 80D of the Income Tax Act, 1961.

A deduction under Section 80D cannot be claimed if payment for health insurance premium is done by cash. Payment for the medical expense can be made by cash, if payment is made on behalf of working children, siblings, grandparents or any other relative and group health insurance premium made by the company on behalf of the employee.

Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or incurring eligible expenses. It allows a maximum deduction of Rs 1.5 lakh every year from the taxpayers total income.

The benefit of this deduction can be availed by Individuals and HUFs. Companies, partnership firms, LLPs cannot avail the benefit of this deduction. Section 80C allows deduction for investment made in PPF , EPF, LIC premium , Equity linked saving scheme, principal amount payment towards home loan, stamp duty and registration charges for purchase of property, Sukanya smriddhi yojana (SSY) , National saving certificate (NSC) , Senior citizen savings scheme (SCSS), ULIP, tax saving FD for 5 years, Infrastructure bonds etc.

The Institute of Chartered Accountants of India ( ICAI ) has enabled the Multipurpose Empanelment Form 2021-22 for Chartered Accountants.

The Professional Development Committee (PDC) has hosted the Multipurpose Empanelment Form (MEF) for the year 2021-22, which is available at https://meficai.org/. This year ICAI has made the MEF application simpler and more user-friendly.

The data pertaining to members and firms will be auto-populated from the SSP Database. All data appearing in the green fields are un-editable and members should ensure the correctness of the data. In case of any mismatch in the data of the green fields, kindly modify the same at the SSP Portal and indicate such changes in the comment box given against green fields in the MEF Application. The ICAI has advised the members to doubly cross-check and verify the authenticity of the data thereat.

OTP based Validation of Declaration

For this year also the declaration for the MEF Application will be sought from the member/ partners/ proprietor through validation of One Time Password (OTP) instead of scanned/digital signatures as was done in the past.

In the case of Partnership firms, all the continuing partners must validate the declaration through OTP, else the MEF application will not be treated as submitted. In case all the continuing partners are not able to validate as any partner has retired/left or any other reason, such reason be informed, and the remaining partner may validate the OTP.

OTP will be sent to the Email-id and Mobile Number as registered in SSP of ICAI. Any modification required in email or mobile number has to be done in SSP only. No such changes would be allowed in MEF. Any such change will be reflected in MEF on a real-time basis through the Refresh Button in MEF

Common Partners

The information of association of the partner/proprietor/member elsewhere will be shared immediately to the applicant on logging into the MEF.

The firms with common partners who will withdraw from Bank Branch Auditors’ Panel (for making one firm eligible for Bank Branch Auditors’ Panel) will be considered for other Panels.

It may be noted that change in any data in MEF will only be considered if it is updated and reflected in SSP of ICAI at the link eservices.icai.org

Category / Ineligibility of Application

The category will be informed to the applicant on the submission of the Declaration validated through OTP by the continuing Partners / Proprietor / Member practicing in his individual name. Further, in case of the applicant is ineligible for Bank Branch Auditors’ Panel, the reason, therefore, would be exhibited in the acknowledgment after submission of the Declaration.

Material Mismatch in Information Submitted

The attention of the members is invited that we have been noting material mismatches in the information submitted during the MEF filing and the same will be viewed seriously. In case the same is not found in the order it shall be reported for further action. As in the past, cases selected at random for scrutiny will also be required to submit their supporting documents for verification by the office.

It is suggested that applicants may first go through the “Advisory” for Filling Multipurpose Empanelment Form 2021-22 and for any further query/clarification, please lodge your complaint online on the MEF portal. If the same is not resolved within 5 working days, members can write at mefpdc@icai.in or call at the below mentioned mobile numbers between 3 PM to 5 PM on all working days by quoting Complaint Number.

In a major relief to Ceebros Hotels, the Madras High Court deleted disallowance as substantial activities done to show property purchased is put to use.

The assessee, Ceebros Hotels was running a Hotel and Real Estate business and offered a total income of Rs.120.27 Crores from Rooms Revenue, Restaurants, and Banquets Revenue, Contract Profits recognized, Other Operating Revenues, Rental Revenue, etc. A major portion of the revenue was received from the Hotel business. For the Assessment Year 2015-16, the assessee had offered income from the Real Estate in respect of the project, namely, ‘Atlantic’ at Egmore. An amount of Rs.41,37,73,978/- was claimed towards “Interest Payable” at 13.75% p.a. on a loan amount of Rs.301.92 Crores, obtained from IFCI Limited, which was outstanding as of 31.03.2015.

The Assessing Officer observed that the said loan was obtained for the specific purpose of purchasing the land to an extent of 90.53 grounds in MRC Nagar. According to the Assessing Officer, the assessee had entered into the business of Real Estate for the first time during the Assessment Year 2015-16, in which, the assessee had offered some income from the Real Estate business.

The division bench of Justice T.S.Sivagnanam and Justice Sathi Kumar Sukumar Kurup observed that the loan which was obtained by the assessee from IFCI Limited is for the purpose of the business of the assessee and having accepted the said fact, the deduction of interest was disallowed only on the ground that the asset purchased by the assessee in MRC Nagar was not put to use in the Assessment Year under consideration for the purpose of the business of the assessee.

The court held that the attempt to apply the proviso to the case of the assessee would lead to wrong interpretation of the law and therefore, the reasons given by the Assessing Officer to disallow the interest expenditure by applying the provisions of Section 36(1)(iii) is not in accordance with the law. Further, the Tribunal noted that the assessee is into the business of Real Estate Development and in the process of executing two projects at different places and the Assessing Officer was not justified in treating the two projects on a stand-alone basis and also that the property in MRC Nagar was not put to use. Further, the Tribunal observed that the purchase of inventory in the course of carrying on business should be reckoned as the continuation of the same business activity in the normal course and cannot be equated or termed as an extension of business activity. Furthermore, the Tribunal noted that the assessee has offered substantial income from the Atlantic project and the attempt to apply the Matching Concept principle is misconceived.

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India (ICAI) has notified the Lists of Valid Nominations for election to the Twenty-Fifth Council and Twenty Fourth Regional Councils and central council.

“In pursuance of sub-rule (1) of rule 13 of the Chartered Accountants (Election to the Council) Rules, 2006 read with sub-regulation (10) of regulation 134 of the Chartered Accountants Regulations, 1988, the List of Valid Nominations for election to the Twenty-Fifth Council and Twenty Fourth Regional Councils has been sent to each candidate whose nomination has been accepted by the Panel for Scrutiny vide letter dated 7th October 2021. The List of valid Nominations for Central Council and Regional Councils is also available on the website of the Institute for the general information of members at large,” the ICAI said.

The URL for checking the list of valid nominations for Central Council is and for central council here. The Institute mentioned that under Rule 14 of the aforesaid Rules, withdrawal of candidature can be made by a candidate by giving a notice in his/her own hand and duly signed by him/her and delivered to the undersigned (CA. (Dr.) Jai Kumar Batra, Returning Officer, and Acting Secretary, The Institute of Chartered Accountants of India, ICAI Bhawan, Indraprastha Marg, New Delhi – 110 002) on or before 6.00 P.M. on 18th October 2021. Any candidate who has given notice of withdrawal of his/her candidature shall not be allowed to cancel or withdraw that notice.

Read the Complete List of Valid Nominations Click here.

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.

The Institute of Chartered Accountants of India ( ICAI ) President CA Nihar Jambusaria has advised the CA Students to Prepare to become a Global Professional.

CA Nihar Jambusaria has said that, Being students of this esteemed profession, you need to constantly update your knowledge beyond the curriculum. You must prepare yourself for the next generation accounting with the policy guidelines in sync with the world in order to be future-ready. International accounting bodies are focusing on Sustainability Reporting in order to exhort and prepare robust global businesses that can ensure inclusive growth and prosperity post the pandemic.

At ICAI, the Sustainability Reporting Standards Board has been set up last year with an objective to formulate and issue Sustainability Accounting Standards, develop apt reporting technology platforms such as XBRL Taxonomies and analytical tools/ techniques, provide guidance per se and interpretation of standards and collaborate with the Government/Regulators to propagate these standards.

He also said that, as a budding accounting professional, you must get an overview about Sustainability Reporting and other new-age developments such as Valuation methods, Insolvency process, etc. so as to identify the underlying opportunities in the upcoming thrust area not only in the local business environment but also to become a global accountant.

The Institute of Chartered Accountants of India (ICAI) has extended the payment of membership / COP fee to 31st December 2021.

The Council of ICAI has suo moto decided to extend the last date for payment of Membership/ COP fee for the year 2021-22 from 30th September 2021 to 31st December, 2021.

Members, who have not paid their fee, are requested to pay online through Self-Service Portal (SSP) at the link https://eservices.icai.org/

Twitter is flooded with the disapproval of the CMA Students on the recently issued notification by ICMAI postponing the ICAI CMA Intermediate and Final Examination of the Institute for the June, 2021 session due to unavoidable circumstances.

The Intermediate and Final Examination 2021 were scheduled to be held from October 21 to October 28, 2021.

“Dear ICMAI students want to know what are the “unavoidable circumstances” due to which institute merged the exams. we want offline exams. It’s a professional course, let it be professional,” one of the ICMAI Students tweeted.

“ICMAI we need clarification about reasons for not conducting exams. We struggling to from past 1 year without exams students are worried about CMA members decision and we have spoiled our life since from 3 years,” another tweet said.

One of the tweets supporting the offline exams said, “Bring back offline exams if you are not capable of taking online exams even after experimenting on so many students and wasting their time.” “Why ICAI CMA Has not able to take Exams to form Last 10 month why such a Big Mismanagement has happened in history Why Always students got suffered for Exams from last 1.5 year we want justice,” the tweet read.

The Information Technology giant Infosys acknowledged that some customers proceed to expertise difficulties in accessing the earnings tax portal and warranted that it’s working expeditiously, in collaboration with the Revenue Tax Division, to further streamline end-user expertise.

Infosys informed in a BSE filing that so far, up to three crore taxpayers have been able to successfully complete their necessary transactions and around 1.5 crore Income-Tax Returns were filed through the new portal.

The Bengaluru-based firm, which has drawn flak for glitches persevering with months after the launch of the portal in June, mentioned it has seen regular improvement in utilization over a previous couple of weeks, and greater than three crore taxpayers have logged into the portal and efficiently accomplished numerous transactions.

Services Available

The e-verification, which is mostly done via Aadhaar OTP authentication. An Electronic Verification Code (EVC) is a 10-digit alpha-numeric code that is sent to your mobile number and email ID registered with the e-Filing portal/bank account / Demat account (as the case may be) during the process of e-Verification. It has a 72-hour validity from the time of its generation.

The portal is facilitating over 2.5 lakh returns submitting every day and ITR 1, 2, 3, 4, 5, and seven at the moment are obtainable for submitting. A majority of the statutory varieties have additionally been made obtainable online.

Several critical statutory forms like 15G, 15H, EQ1, 10A, 10E, 10IE, DTVSV, 15CA, 15CB, 35 as well as TDS Returns are being filed in large numbers. An array of statutory forms has also been made available on the portal.

Taxpayer services such as e-proceedings, response to notices and demands, e-PAN services, DSC registrations, and functionality for legal heir, are also available to users now.