- Home

- »

- Avinash Kurungot

Avinash Kurungot

Avinash Kurungot is a B.B.A. LL.B (Hons.) Graduate from Christ University, Bangalore. Following a stint in Civil Litigation, marking appearances across the High Court of Kerala and various sub-courts, he has channelled his skills towards developing engaging tax, finance and news content.

S.K. Rahman IRS, Chief Commissioner of CGST & Customs Launches TAXSCAN 2.0

Chief Commissioner of CGST & Customs, Thiruvananthapuram Zone, Shri S.K. Rahman, IndianRevenue Service (IRS), yesterday (4th June, 2025) launched...

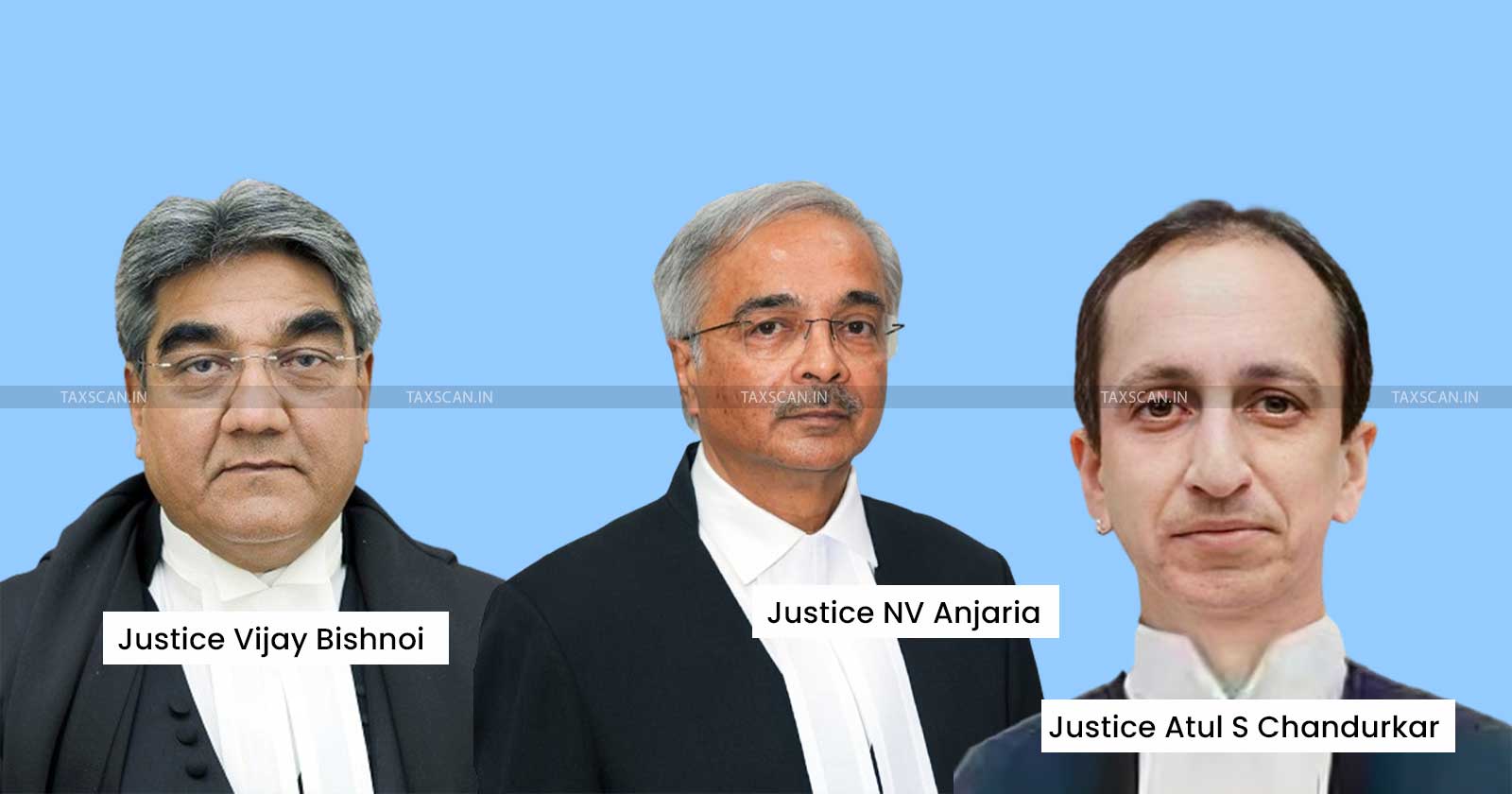

Retrospective Notification on GST ITC Refund due to Ledger Mismatch cannot Bar Application Made After Issue Date: Supreme Court [Read Order]

The Supreme Court of India summarily dismissed a batch of Special Leave Petitions filed by the Assistant Commissioner of Central Taxes, refusing to interfere with the decision of the Andhra Pradesh...

ICSI Announces Post-Membership Qualification Course on Internal Audit: 20 CPE Credits & Diploma Certificate Assured! Register Now!

The Institute of Company Secretaries of India (ICSI) has opened online admissions for its latest Post Membership Qualification (PMQ) Course on Internal Audit. The course, intended exclusively for...

Comparing Income Tax Deductions/Exemptions under the Old and New Regimes: 80C, 80D, LTA, HRA and More

The Indian tax system continues to effect changes to its tax system every year. One of the most important choices that taxpayers have to make while filing their returns is whether to opt for the old...

GST Refund Cannot Be Credited to Electronic Credit Ledger of Defunct Business with Cancelled Registration: Calcutta HC [Read Order]

A significant ruling was recently passed by the Calcutta High Court, directing the Revenue to reconsider its earlier decision which sanctioned a Goods and Services Tax (GST) refund into the...

![GST Officers Directed to Avoid Ex-Parte Orders During Sales Tax Bar Association Summer Break: Delhi Tax Dept issues Circular [Read Order] GST Officers Directed to Avoid Ex-Parte Orders During Sales Tax Bar Association Summer Break: Delhi Tax Dept issues Circular [Read Order]](https://images.taxscan.in/h-upload/2025/06/04/250x150_2041190-gst-officers-directed-ex-parte-sales-tax-bar-association-summer-break-delhi-tax-dept-taxscan.webp)

![Retrospective Notification on GST ITC Refund due to Ledger Mismatch cannot Bar Application Made After Issue Date: Supreme Court [Read Order] Retrospective Notification on GST ITC Refund due to Ledger Mismatch cannot Bar Application Made After Issue Date: Supreme Court [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/GST-ITC-Refund-site-img.jpg)

![GST Refund Cannot Be Credited to Electronic Credit Ledger of Defunct Business with Cancelled Registration: Calcutta HC [Read Order] GST Refund Cannot Be Credited to Electronic Credit Ledger of Defunct Business with Cancelled Registration: Calcutta HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/GST-refund-Taxscan.jpg)