Begin typing your search above and press return to search.

- Home

- »

- Navasree A.M

Navasree A.M

Navasree A M, B.B.A., LL.B. (Hons), a lawyer with over 2.5 years of experience as a researcher and content writer at Taxscan, specializing in Indirect Taxes and Corporate Laws.

![Section 130 of GST Act Cannot Be Invoked for Mere Stock Variations Found in Search: Supreme Court [Read Judgement] Section 130 of GST Act Cannot Be Invoked for Mere Stock Variations Found in Search: Supreme Court [Read Judgement]](https://images.taxscan.in/h-upload/2025/09/09/500x300_2084844-section-130.webp)

Section 130 of GST Act Cannot Be Invoked for Mere Stock Variations Found in Search: Supreme Court [Read Judgement]

The Supreme Court has upheld the ruling of the Allahabad High Court, holding that Section 130 of the GST (Goods and Services Tax) Act cannot be...

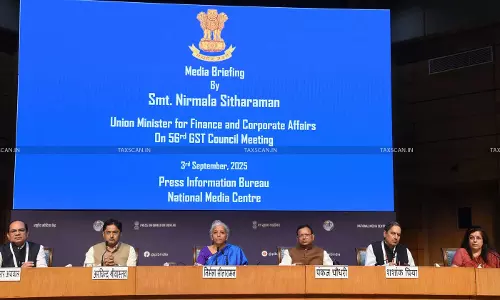

56th GST Council Proposes Omission of S. 13(8)(b): Location of Service Recipient will serve as Place of Supply for Intermediary Services

The 56th GST Council has recommended the omission of clause (b) of section 13(8) of the Integrated Goods and Services Tax (IGST) Act, 2017. At present, section 13(8)(b) deems the place of supply for...

![Service Tax Not applicable on Public Utility Works including Laying of Pipelines, Repairs of Sainik Schools: CESTAT quashes Demand [Read Order] Service Tax Not applicable on Public Utility Works including Laying of Pipelines, Repairs of Sainik Schools: CESTAT quashes Demand [Read Order]](https://images.taxscan.in/h-upload/2025/09/09/250x150_2084820-service-tax-cestat-quashes-taxscan.webp)

![Cash Withdrawal from NRE A/c of Son-in Law deposited during Demonetization Period Sufficiently Explained: ITAT deletes Addition of Rs. 12L [Read Order] Cash Withdrawal from NRE A/c of Son-in Law deposited during Demonetization Period Sufficiently Explained: ITAT deletes Addition of Rs. 12L [Read Order]](https://images.taxscan.in/h-upload/2025/09/09/250x150_2084812-2064969-itat-itat-cash-deposits-during-demonetization-taxscan-1.webp)

![100 bed Requirement for Hospital’s Claim u/s 35AD(8): ITAT allows Deduction after Accepting Medical Director’s Certificate [Read Order] 100 bed Requirement for Hospital’s Claim u/s 35AD(8): ITAT allows Deduction after Accepting Medical Director’s Certificate [Read Order]](https://images.taxscan.in/h-upload/2025/09/08/250x150_2084769-hospitals-claim-requirement-for-hospitals-claim-itat-taxscan.webp)

![[Breaking] Setback to SICPA: Sikkim HC’s Division Bench Overturns Single Bench Ruling on Refund of Unutilised ITC for Closed Business [Breaking] Setback to SICPA: Sikkim HC’s Division Bench Overturns Single Bench Ruling on Refund of Unutilised ITC for Closed Business](https://images.taxscan.in/h-upload/2025/09/08/250x150_2084602-2080780-gst-refund-gst-pending-appeal-delhi-hc-directs-payment-with-interest-taxscan.webp)