Begin typing your search above and press return to search.

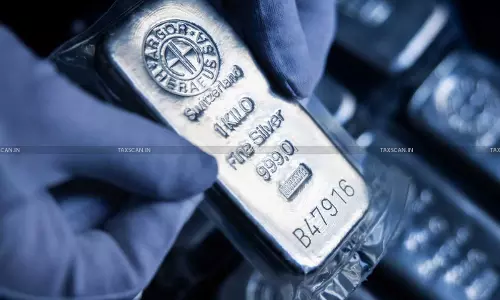

How Much Silver Can You Keep at Home Without Tax in India

Many Indian homes keep some silver, like coins, bars, utensils, or ornaments. A common question people ask is whether there is any limit on how much...

![Interest-Free Advances from Share Capital Don not Attract Notional Tax: ITAT [Read Order] Interest-Free Advances from Share Capital Don not Attract Notional Tax: ITAT [Read Order]](https://images.taxscan.in/h-upload/2026/01/02/250x150_2116709-interest-free-advance-share-capital-taxscan.jfif)

![Chhattisgarh HC Rejects M.Com Student’s Plea for Third Re-Evaluation of Income Tax Marks Over Belated Application Filing [Read Order] Chhattisgarh HC Rejects M.Com Student’s Plea for Third Re-Evaluation of Income Tax Marks Over Belated Application Filing [Read Order]](https://images.taxscan.in/h-upload/2025/12/05/250x150_2110326-chattisgarh-hc-mcom-students-plea-third-re-evaluation-income-tax-marks-application-filing-taxscan.webp)

![IBC Trumps Income Tax Law: Bombay HC Upholds Extinguishment of Pre-Resolution Claims [Read Order] IBC Trumps Income Tax Law: Bombay HC Upholds Extinguishment of Pre-Resolution Claims [Read Order]](https://images.taxscan.in/h-upload/2025/11/28/250x150_2108518-high-court-ibc-tax-demands-resolution-plan-taxscan.webp)

![[BREAKING] Income Tax Act, 2025 notified in Official Gazette for General Information by Ministry of Law and Justice [Read Act] [BREAKING] Income Tax Act, 2025 notified in Official Gazette for General Information by Ministry of Law and Justice [Read Act]](https://images.taxscan.in/h-upload/2025/08/22/500x300_2079680-income-tax-act-2025-income-tax-act-official-gazette-taxscan.webp)

![Interest Received on Delayed Compulsory Agricultural Land Acquisition Compensation be Classified as Capital Gain: Kerala HC [Read Order] Interest Received on Delayed Compulsory Agricultural Land Acquisition Compensation be Classified as Capital Gain: Kerala HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/04/Capital-Gain-1.jpg)

![Kerala HC upholds Income Tax Disallowance Against Employer on Failure to Contribute To EPF/ESI Within Due Date [Read Order] Kerala HC upholds Income Tax Disallowance Against Employer on Failure to Contribute To EPF/ESI Within Due Date [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/07/Kerala-HC-Kerala-High-Court-Income-Tax-Employee-Provident-Fund-Income-Tax-Disallowance-EPF-taxscan.webp)