Begin typing your search above and press return to search.

![High Court in its Writ Jurisdiction cannot act as AO to Scrutinise Facts and Evidences: Calcutta HC [Read Order] High Court in its Writ Jurisdiction cannot act as AO to Scrutinise Facts and Evidences: Calcutta HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/09/High-Court-in-its-Writ-Jurisdiction-High-Court-Writ-Jurisdiction-AO-Scrutinise-Facts-and-Evidences-Scrutinise-Facts-Evidences-Calcutta-High-Court-taxscan.jpg)

High Court in its Writ Jurisdiction cannot act as AO to Scrutinise Facts and Evidences: Calcutta HC [Read Order]

In a recent decision, a Division bench of the Calcutta High Court confirmed the observation of the Single bench of the same court, which stated that...

![Extended Period of Limitation cannot be Invoked unless there is Evidence of Fraud or Collusion or Wilful Misstatement: CESTAT [Read Order] Extended Period of Limitation cannot be Invoked unless there is Evidence of Fraud or Collusion or Wilful Misstatement: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Extended-Period-of-Limitation-Extended-Period-Evidence-of-Fraud-Evidence-Fraud-Collusion-Wilful-Misstatement-Misstatement-CESTAT-Taxscan.jpg)

![Surrendered Income will be treated as Income from Medical Profession unless there is clear Evidence to the contrary: ITAT [Read Order] Surrendered Income will be treated as Income from Medical Profession unless there is clear Evidence to the contrary: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Surrendered-Income-Income-from-Medical-Profession-Evidence-to-the-contrary-Evidence-ITAT-taxscan.jpg)

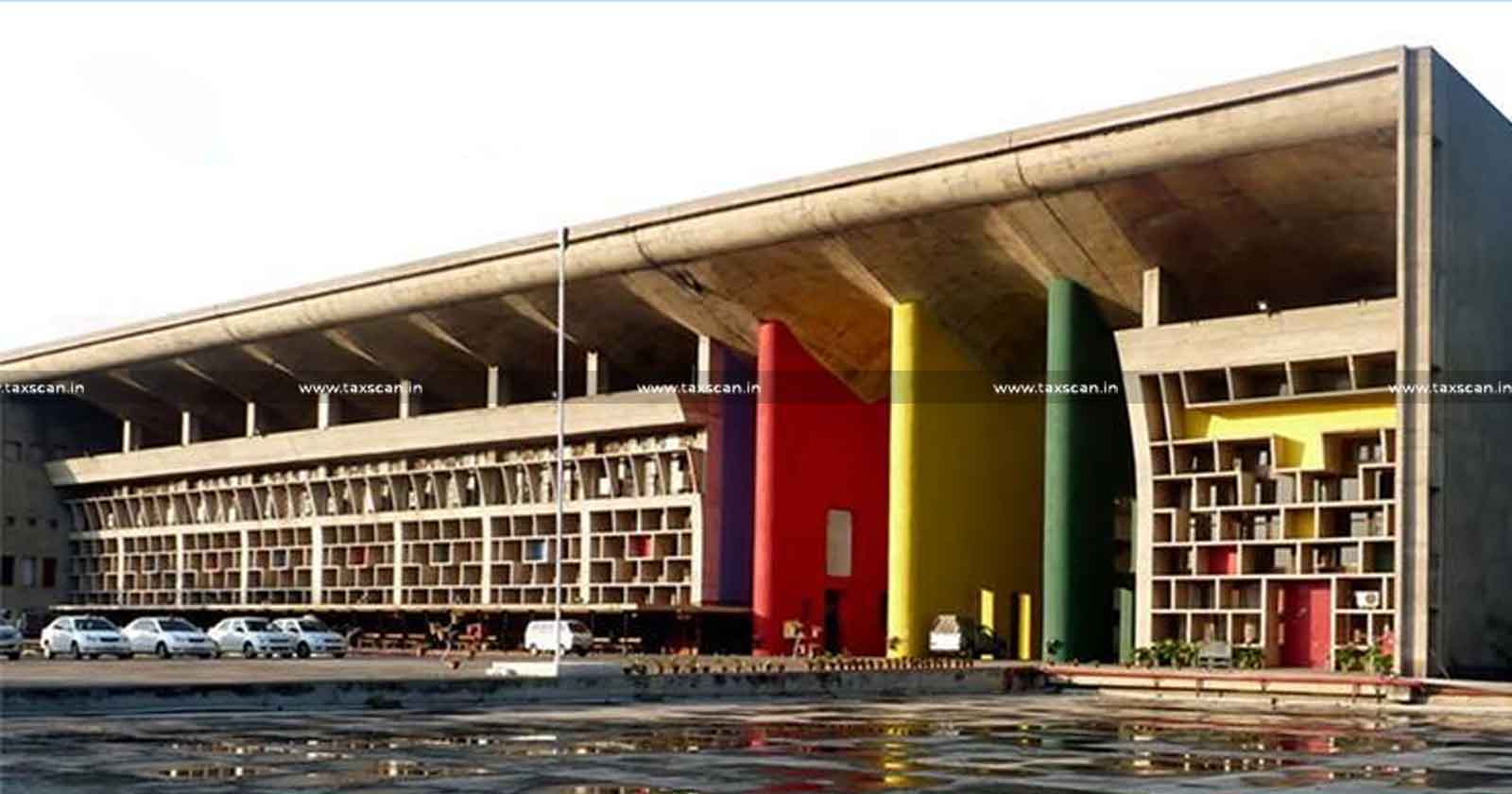

![Trial Court should decide GST Fraud case on Evidence Uninfluenced by Observations in Bail Order: Punjab and Haryana HC [Read Order] Trial Court should decide GST Fraud case on Evidence Uninfluenced by Observations in Bail Order: Punjab and Haryana HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Trial-Court-GST-Fraud-case-GST-Fraud-GST-Evidence-Uninfluenced-by-Observations-in-Bail-Order-Evidence-Bail-Order-Bail-Evidence-Uninfluenced-Punjab-and-Haryana-High-Court-Taxscan.jpg)

![Addition u/s 69 of Income Tax Act shall not be made on basis of ledger account seized from third party on absence of clinching Evidence of Cash Payments towards Purchase of Flat: ITAT [Read Order] Addition u/s 69 of Income Tax Act shall not be made on basis of ledger account seized from third party on absence of clinching Evidence of Cash Payments towards Purchase of Flat: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Income-Tax-Act-shall-not-be-made-on-basis-of-ledger-account-seized-from-third-party-absence-of-clinching-evidence-of-Cash-Payments-towards-purchase-of-Flat-ITAT-TAXSCAN.jpg)

![ITAT allows 10% of Cash Deposits as Taxable Income in Absence of Evidence of Source u/s 69A of IT Act [Read Order] ITAT allows 10% of Cash Deposits as Taxable Income in Absence of Evidence of Source u/s 69A of IT Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/ITAT-Cash-Deposits-Taxable-Income-Absence-Evidence-Source-IT-Act-TAXSCAN.jpg)

![CIT(A) passed Order not on Merits: ITAT Directs Re-Adjudication taking Cognizance of Evidences [Read Order] CIT(A) passed Order not on Merits: ITAT Directs Re-Adjudication taking Cognizance of Evidences [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/CITA-Order-Merits-ITAT-Re-Adjudication-ITAT-Directs-Re-Adjudication-Cognizance-of-Evidences-Cognizance-ITAT-Directs-Re-Adjudication-taking-Cognizance-of-Evidences-Taxscan.jpg)

![Failure to Furnish Material Evidence of Rs. 1 crore Gift Received on Marriage: ITAT sustains addition of Partial Amount as Unexplained Money [Read Order] Failure to Furnish Material Evidence of Rs. 1 crore Gift Received on Marriage: ITAT sustains addition of Partial Amount as Unexplained Money [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Failure-Furnish-Material-Evidence-Gift-Received-Marriage-ITAT-Partial-Unexplained-Money-taxscan.jpg)

![Relief to Asian Plywood Industries: CESTAT Quashes Demand of Customs Duty of Approx. 2.5 Crores for Clandestine Removal of Goods on Ground of Absence of Corroborative Evidence [Read Order] Relief to Asian Plywood Industries: CESTAT Quashes Demand of Customs Duty of Approx. 2.5 Crores for Clandestine Removal of Goods on Ground of Absence of Corroborative Evidence [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/08/Relief-Asian-Plywood-Industries-Relief-to-Asian-Plywood-Industries-CESTAT-CESTAT-Quashes-Demand-of-Customs-Duty-taxscan.jpg)