Begin typing your search above and press return to search.

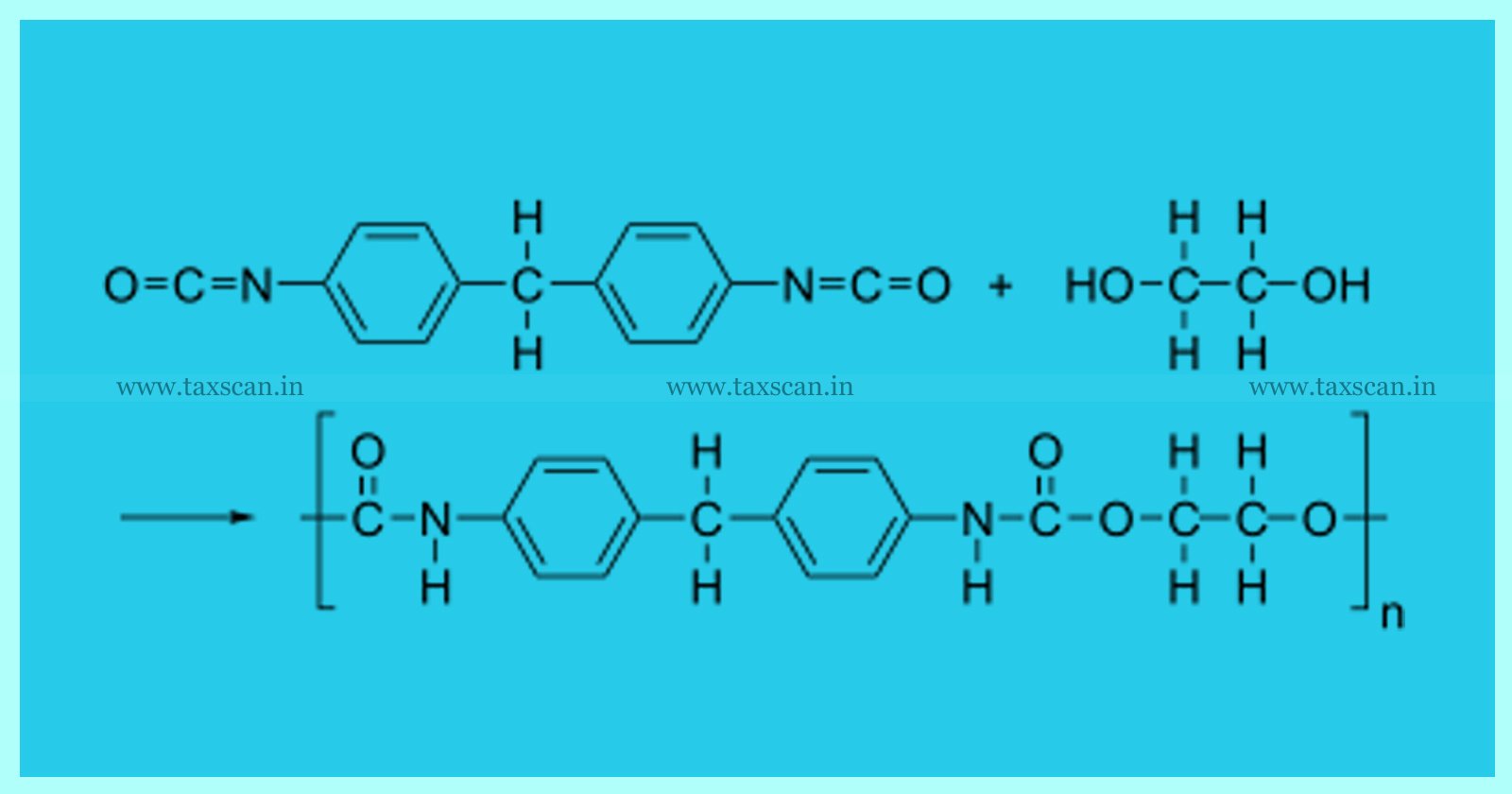

Madras HC orders retest to determine presence of Polyurethrene for Imposing Anti-dumping Duty [Read Order]

A Single Bench of the Madras High Court ordered retest to determine presence of Polyurethrene for imposing Anti-dumping duty. The Petitioner,...

![Lapse of 16 years: Madras HC directs to Pay Differential Duty on Portable Emergency Lamp [Read Order] Lapse of 16 years: Madras HC directs to Pay Differential Duty on Portable Emergency Lamp [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/02/Madras-High-Court-Portable-Emergency-Lamp-Emergency-Lamp-taxscan.jpg)

![Re-Assessment based on Change of Opinion: Bombay HC Quashes Income Tax Proceedings against Mumbai Postal Employees [Read Order] Re-Assessment based on Change of Opinion: Bombay HC Quashes Income Tax Proceedings against Mumbai Postal Employees [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/02/Re-Assessment-Bombay-Highcourt-Income-Tax-Proceedings-Mumbai-Postal-Employees-Income-Tax-taxscan.jpg)

![Money Laundering Case-Territorial Jurisdiction cannot be decided in Writ Petition: SC [Read Judgement] Money Laundering Case-Territorial Jurisdiction cannot be decided in Writ Petition: SC [Read Judgement]](https://www.taxscan.in/wp-content/uploads/2023/02/Money-Laundering-Case-Money-Laundering-Territorial-Jurisdiction-Writ-Petition-Taxscan.jpg)

![Kerala HC Allows Payment of Motor Vehicle Tax in Installments [Read Order] Kerala HC Allows Payment of Motor Vehicle Tax in Installments [Read Order]](/images/placeholder.jpg)

![Time Barred GST Claim for Refund of Eligible excess ITC amount: Madras HC allows submission of Manual Application [Read Order] Time Barred GST Claim for Refund of Eligible excess ITC amount: Madras HC allows submission of Manual Application [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/01/TIme-Barred-GST-Claim-Refund-of-Eligible-excess-ITC-amount-Madras-HC-submission-of-Manual-Application-Taxscan.jpg)

![Quashing S. 130 Notice by High Court through Writ Petition was “Inappropriate”: Supreme Court [Read Judgment] Quashing S. 130 Notice by High Court through Writ Petition was “Inappropriate”: Supreme Court [Read Judgment]](https://www.taxscan.in/wp-content/uploads/2023/01/Notice-High-Court-Writ-Petition-Supreme-Court-taxscan.jpg)

![Order u/s 148A(D) of Income Tax Act Is Not a Final Assessment Order: Calcutta HC dismisses Writ Petition [Read Order] Order u/s 148A(D) of Income Tax Act Is Not a Final Assessment Order: Calcutta HC dismisses Writ Petition [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/01/Income-Tax-Act-Income-Tax-Assessment-Order-Calcutta-Highcourt-Writ-Petition-taxscan.jpg)

![No Loss of Revenue: Madras HC quashes Charge Memo against Former VAT Officer [Read Order] No Loss of Revenue: Madras HC quashes Charge Memo against Former VAT Officer [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/01/Loss-of-Revenue-Revenue-Madras-High-Court-Charge-Memo-VAT-Officer-VAT-taxscan.jpg)

![Madhya Pradesh HC Dismisses Writ Petition When Statutory Remedy available [Read Order] Madhya Pradesh HC Dismisses Writ Petition When Statutory Remedy available [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/01/Madhya-Pradesh-Highcourt-Writ-Petition-taxscan.jpg)

![Additional Liability after GST Rate Changes: Chhattisgarh HC directs Dept to Consider Representation [Read Order] Additional Liability after GST Rate Changes: Chhattisgarh HC directs Dept to Consider Representation [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/01/Additional-Liability-GST-Rate-GST-Chhattisgarh-High-Court-taxscan.jpg)

![Chartered Accountant approaches Kerala HC citing Technical Glitches on MCA Portal [Read Petition] Chartered Accountant approaches Kerala HC citing Technical Glitches on MCA Portal [Read Petition]](https://www.taxscan.in/wp-content/uploads/2023/01/Chartered-Accountant-Kerala-HC-citing-Technical-Glitches-MCA-Portal-Taxscan.jpg)