Begin typing your search above and press return to search.

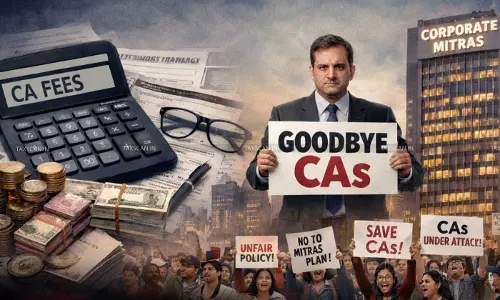

“Are CAs Too Expensive?” Budget 2026’s Corporate Mitras Plan Triggers Outrage

The Union Budget 2026 announcement on introducing “Corporate Mitras” has triggered concern and debate among Chartered Accountants, Company Secretaries...

![₹1.38 Cr Income Tax Addition on Unaccounted Profit from Business Transaction: ITAT Directs Fresh Adjudication by CIT(A) [Read Order] ₹1.38 Cr Income Tax Addition on Unaccounted Profit from Business Transaction: ITAT Directs Fresh Adjudication by CIT(A) [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/250x150_2123601-itat-new-delhi-income-tax-addition-unaccounted-profit-business-transaction-fresh-adjudication-cita-taxscan.webp)

![GST Appeal Rejected for Delay despite High Court’s Direction to Not Insist upon Limitation: Madras HC directs Readjudication [Read Order] GST Appeal Rejected for Delay despite High Court’s Direction to Not Insist upon Limitation: Madras HC directs Readjudication [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/250x150_2123595-gst-appeal-rejected-delay-despite-high-courts-direction.webp)

![J&K HC sets aside S. 63 GST Assessment Passed against Registered Entity Treated as Unregistered [Read Order] J&K HC sets aside S. 63 GST Assessment Passed against Registered Entity Treated as Unregistered [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/250x150_2123584-jammu-kashmir-high-court-gst-assessment-registered-entity-unregistered-taxscan.webp)

![Ignoring GSTR-3B and GSTR-9 data is ‘Clear Abdication of Duty’: Calcutta HC set aside Appellate Order [Read Order] Ignoring GSTR-3B and GSTR-9 data is ‘Clear Abdication of Duty’: Calcutta HC set aside Appellate Order [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/250x150_2123579-ignoring-gstr-3b-gstr-9-data-clear-abdication-duty-taxscan.webp)

![GST Portal Service Valid Even after Cancellation of Registration: AP HC Rejects Appeal Filed After One Year [Read Order] GST Portal Service Valid Even after Cancellation of Registration: AP HC Rejects Appeal Filed After One Year [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/500x300_2123577-gst-portal-service-valid-even-after-cancellation-registration-ap-hc-rejects-appeal-filed-after-one-year-taxscan.webp)

![Rajasthan HC Declines to Interfere with ₹5.45 Crore GST Demand Citing Alternative Appellate Remedy [Read Order] Rajasthan HC Declines to Interfere with ₹5.45 Crore GST Demand Citing Alternative Appellate Remedy [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/500x300_2123573-rajasthan-hc-declines-interfere-545-crore-gst-demand-citing-alternative-appellate-remedy.webp)

![₹28.5 Lakh Fraudulent Trading Liability on Suspended Directors u/s 66 IBC Set Aside: NCLAT [Read Order] ₹28.5 Lakh Fraudulent Trading Liability on Suspended Directors u/s 66 IBC Set Aside: NCLAT [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/500x300_2123563-285-lakh-fraudulent-trading-liability-suspended-taxscan.webp)

![Supreme Court Upholds ₹2.9 Crore GST Refund to SAIL on Unutilised ITC of Coal [Read Order] Supreme Court Upholds ₹2.9 Crore GST Refund to SAIL on Unutilised ITC of Coal [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/500x300_2123567-itc-refundjpg.webp)

![Lack of Signature Makes GST Order Invalid and Unserved: AP HC directs Fresh Notice Excluding Certain Time for Limitation [Read Order] Lack of Signature Makes GST Order Invalid and Unserved: AP HC directs Fresh Notice Excluding Certain Time for Limitation [Read Order]](https://images.taxscan.in/h-upload/2026/02/03/500x300_2123559-lack-signature-makes-gst-order-invalid-unserved-ap-hc-directs-fresh-notice.webp)