Telangana HC quashes Non-Faceless Income Tax Notices, rebukes Dept. for not following Established Precedents [Read Order]

The Telangana High Court noticed that itself and various other high courts had settled this insistent subject, but were impending a binding verdict from the Supreme Court.

![Telangana HC quashes Non-Faceless Income Tax Notices, rebukes Dept. for not following Established Precedents [Read Order] Telangana HC quashes Non-Faceless Income Tax Notices, rebukes Dept. for not following Established Precedents [Read Order]](https://images.taxscan.in/h-upload/2025/07/21/2066898-incometax-notice-taxscan.webp)

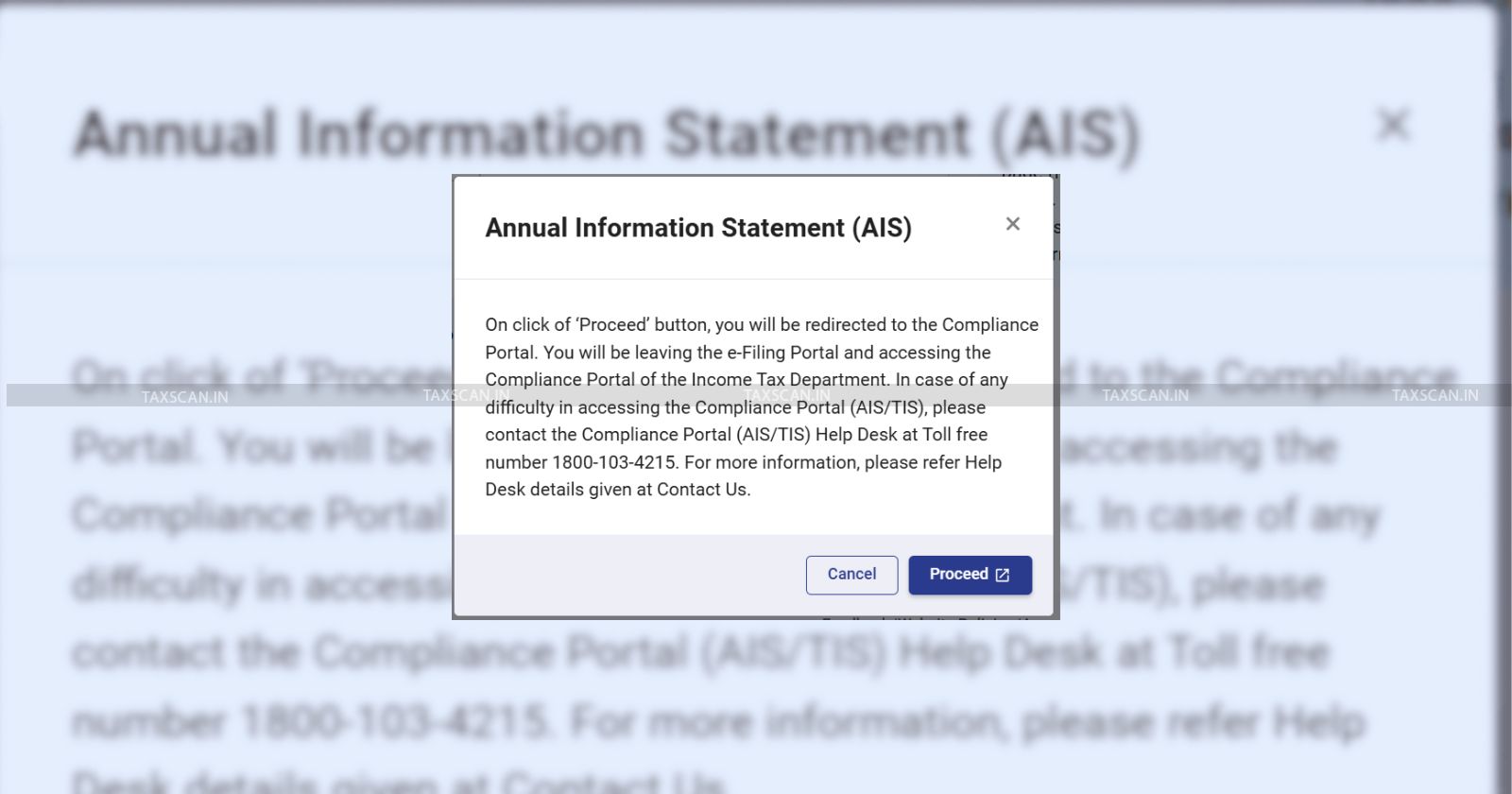

The Telangana High Court recently set aside income tax notices issued to a taxpayer, on the ground that the Income Tax Department failed to issue them in compliance with the mandatory faceless assessment procedure, thus disregarding binding judicial precedents that have adjudicated on the matter.

Rakesh Reddy Paidi instituted the writ petition against the Union of India and its tax authorities, challenging the legality of notices issued under Sections 148A and 148 of the Income Tax Act, 1961 for the assessment year 2021–2022.

Also Read:Income Tax Reassessment Initiated During Pending Assessment Proceedings: Delhi HC Sets Aside Order for Lack of Jurisdiction [Read Order]

Also Read:Income Tax Reassessment Initiated During Pending Assessment Proceedings: Delhi HC Sets Aside Order for Lack of Jurisdiction [Read Order]

and for the Revenue by Ms. B. Sapna Reddy, Senior Standing Counsel for the Income Tax Department.

The petitioner, represented by Sheetal Srikanth contended that the notices and consequential proceedings purported by the department were violative of Section 151A of the Income Tax Act as amended by the Finance Act, 2021 which mandated that such notices must be issued in a faceless manner.

Know Practical Aspects of Tax Planning, Click Here

It was submitted that the issue was no longer res integra, alluding to the Telangana High Court’s decision in Kanakala Ravindra Reddy v. Income-Tax Officer (2023), where the Court had quashed similar notices for non-compliance with the faceless regime.

The Revenue, represented by B. Sapna Reddy did not dispute that the notices had been issued in a non-faceless arrangement, but argued that the Supreme Court was privy of the matter and a batch of pending Special Leave Petitions were pending adjudication before the Apex Court. The counsel further submitted that further quashing of notices would unnecessarily burden the department, requiring them to file more Special Leave Petitions before the Supreme Court.

The Bench comprising Justice P. Sam Koshy and Justice Narsing Rao Nandikonda noted that, despite numerous unambiguous judicial pronouncements by the Telangana High Court and several other High Courts across the country barring the issuance of non-faceless notices, the Income Tax Department has continued to pursue the same process, leading to a surge in litigation on an issue that has already settled by judicial precedents.

Want a deeper insight into the Income Tax Bill, 2025? Click here

The Bench also cited the Bombay High Court's decision in Bank of India v. Assistant Commissioner, Income Tax (2025) where the Court reiterated the need for the department to exercise judicial discipline and abide by matters settled by a higher court.

Also Read:Delay in Granting Gazetted Status to Deputy State Tax Officers: Telangana HC Directs Authorities to Decide Representation in 8 Weeks [Read Order]

Also Read:Delay in Granting Gazetted Status to Deputy State Tax Officers: Telangana HC Directs Authorities to Decide Representation in 8 Weeks [Read Order]

Concluding, the Court allowed the writ petition and quashed the impugned notices and all consequential proceedings, clarifying that such disposal was subject to the outcome of the pending Special Leave Petitions before the Supreme Court.

Support our journalism by subscribing to Taxscanpremium. Follow us on Telegram for quick updates