The Income Tax Appellate Tribunal (ITAT), Bangalore has granted relief to Cafe Coffee Day and held that foreign exchange loss due to the reinstatement of the accounts at the end of the financial year as well as loss incurred on account of exchange fluctuation on repayment of borrowings is similar to the interest expenditure and it is to be allowed as revenue expenditure u/s 37 of the Income Tax Act.

The CIT(A) deleted the addition by observing that the assessee had been consistently treating the gain/loss as revenue. The CIT(A) observed that there are various occasions in the past wherein the similar gain had been offered as income and the same was accepted by the department from A. Y.2004-05 till A. Y.2011-12.

According to the CIT(A), the AO, for the first time, disturbed the similar loss on Forex claimed by the assessee for the A.Y.2012-13 by making the disallowance of forex loss. The CIT(A) had deleted the addition in his order on relying on the various judicial pronouncements and also based on the principles of consistency as the assessee’s treatment of similar Forex Gain was accepted as income by the AO in earlier years.

The order of CIT(A) for the A.Y. 2012-13, the CIT(A) held that the foreign exchange fluctuation loss here in the peculiar facts and circumstances is an allowable revenue expense and deleted the addition made consequent to disallowance of expenditure of Forex Loss.

The ITAT bench comprising of Judicial Member, Beena Pillai, and Accountant Member, Chandra Poojari pronounced the order an appeal filed against Cafe Coffee Day.

In the light of the judgment of the Supreme Court in the case of CIT vs. Woodward Governor India Pvt. Ltd. had already held that the actual payment was not a condition precedent for making the adjustment in respect of foreign currency transactions at the end of the closing year.

While dismissing the appeal the Coram said that it is not able to concur or agree with the view of the Assessing Officer that liability could arise only when the contract would have matured as such a stand is totally divorced from the accounting principles and is in variance with the principle.

The ITAT further said that foreign exchange loss is due to the reinstatement of the accounts at the end of the financial year as well as loss incurred on account of exchange fluctuation on repayment of borrowings is similar to the interest expenditure and it is to be allowed as revenue expenditure u/s 37 of the I.T.Act, as per the accounting standard approved by the Institute of Chartered Accountants of India (ICAI).

Subscribe Taxscan Premium to view the JudgmentThe Uttar Pradesh State Rural Livelihoods Mission (UPSRLM) has announced various vacancies including Chartered Accountants and Chartered Accountant (CA) interns. It is an autonomous registered society under the aegis of the Rural Development Department, Govt. of UP. The mission is mandated to implement the National Rural Livelihoods Mission (NRLM) across the state and therefore aims at creating efficient and effective institutional platforms of the rural poor enabling them to increase household income through sustainable livelihood enhancements and improved access to financial services.

Interested candidates should apply online latest by 7th March 2020. The online application portal will be live within 48 hours from the date of publishing this advertisement. Applications through any other means will not be accepted.

The available vacancies are:

| Position& Salary Range | Eligibility Criteria | Vacancies Available |

| Mission Manager – Admin & FM RS 45,000- 75,000 per month | Educational Qualification- MBA in Finance/CA/ICWA from recognized university/institute/or Post Graduate Diploma in above discipline from recognized university/institute with at least 55% minimum marks or equivalent grade. Work Experience- 05 years of relevant post qualification work experience in Finance and Administration in a large scale program / Organization. Should have experience in taxation and other statutory formalities of government/and other international agencies, experience in working of a world bank funded Mission at the state/national level of which at least 2 years should be at District/ State / National level. | 1 |

| Senior Technical Expert/ SPM Enterprise Promotion

Rs. 75,000 – 1,00,000 per month | Educational Qualification: MBA in Finance/Rural Management/ Marketing/supply chain management from an institution of repute or CA or ICWA

Work Experience: At least 7 years of experience of working in non-farm livelihoods sectors like micro-enterprises development, Collectives, and Producer Companies or in the private sector in a business leadership /management role Experience of providing business month advisory services, developing forward and backward linkages for businesses in the non-farm livelihoods sector. Experience of managing /starting a business and managing them for growth and profitability will be given preference Demonstrable experience of project management and team management ensuring the delivery of the high-quality program. The skill of managing a business, preparing business plans, evaluating financial viability and business plans, are key skills that are critical for this role. | 1 |

| Technical Expert/ PM Enterprise Promotion

RS 45,000 – 75,000 per month | Educational qualification- MBA in Finance /Rural Management/ Marketing from an institution of repute or CA or

Work Experience- Minimum of 5 years of experience working on sales/marketing support to clusters/micro and = small enterprises. Preference will be provided to candidates with experience in the private sector. Experience in working in teams and managing relationships with all stakeholders. Strong in numeracy, analytical, and business skills. Good team player with a strong ability to work in teams and with people with no direct reporting relationships. | 1 |

| Account Assistant

RS 30,000- 50,000 Per month | Educational qualification- MBA (Finance) / CA (Inter) /CS(Inter)/M.Com from recognized university /institute/or PG Diploma in above discipline from recognized university /institute.

Work Experience-Should have of at least 03 years of relevant post-qualification work experience in the field of Accounting and Finance in large development Mission, of which at least 1 year should be at the block level or above | 2 |

(AU positions mentioned above would be on the rolls of the service provider engaged by Uttar Pradesh State Rural Livelihoods Mission)

To Apply, Click here.

The newly incorporated Kerala State Co-operative Bank Ltd. (Kerala) has published vacancies in the categories of Chief IS Security and IT Officer, Head Treasury, Chief Risk Officer, Chief Finance Officer, and Chief Legal Officer

For the position of Head Treasury the expected qualification from aspirants are:

(1)Persons with a minimum of 15 years experience in any leading public / private sector Bank, out of which 4 years in Treasury Management at the level of Assistant General Manager or above.

(2) Professional qualifications like MBA (Finance) / CAIIB/CA and exposure in the above-mentioned areas preferred.

(3) Age Limit is set at 62 years

For the position of Chief Risk Officer the expected qualification from aspirants are:

Professional certification in Financial Risk Management (FRM) from the Global Association of Risk Professionals.

Or Professional Risk Management (FRM) Certification from PRMIA Institute.

Five years experience in Corporate credit and risk management at the level of Assistant General Manager or above in one or more Scheduled Public/Private Sector Banks, or having similar roles and responsibilities in one or more regulated lending entity, with minimum experience of one year in corporate credit and one year in risk management.

The age limit is set at 62 years.

For the vacancies of Chief Finance Officer at Kerala bank the expected qualification from aspirants are:

(1) Graduation in any stream from a recognized university.

(2) CA from Indian Chartered Accountants Institute (ICAI).

(3) At least a minimum of 10 years experience as Auditors. Out of which a minimum of 5 years experience in the Statutory Audit of a Public Sector/Private Sector Bank. (Additional Qualification MBA, ICWA preferred). Desirable – Worked as CFO in PSU Banks or Private Sector Banks.

(4) Age Limit is set at 45 to 55 years

For the vacancies of Chief Legal Officer at Kerala bank the expected qualification from aspirants are:

1) Bachelor’s Degree in Law from a recognized University, approved by Bar Council of India for the purpose of enrolment as an Advocate.

2) 10 years active practice in the Bar (Court of Law) with experience in handling cases related to Banking Laws, Co-operative Laws, service matters, SARFAESI, civil and criminal laws. OR At least 5 year of post-qualification experience in handling cases related to Banking Laws, Co-operative Laws, Service matters, SARFAESI Act, Civil and Criminal laws, etc as AGM or above in the Nationalised or Private Sector Bank / Senior Executive or Senior Officer in the Legal department of Government /Semi-Government / Public Sector Undertaking / Companies listed on NSE / BSE.

(3) Age Limit – 45 to 55 years

Interested Applicants may send in their application to The Deputy General Manager (P&E), (Kerala State Co-operative Bank Ltd., Palayam, Thiruvananthapuram – 33.)The Last date for receipt of application is 2nd March 2020.

For Further Information Click here.

The Ministry of Finance has notified that Non-Banking Financial Institutions (NBFCs) having assets worth 100 Crore rupees and above can be conferred the status of Financial institutions.

This comes in the exercise of the powers conferred by subclause (iv) of clause (m) of subsection (1)of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act or SARFAESI Act, 2002.

A financial institution is a company dealing with financial and monetary transactions. In India, commercial banks, investment banks, insurance companies, and brokerage firms usually function as financial institutions. They are able to supply money when none is available on the market. NBFCs on the other hand, do not hold banking licenses but can provide bank-like functions.

Earlier the eligibility limit of debt recovery of NBFCs according to SARFAESI Act stood at Rs.500 Crore of asset size or loan size of Rs.1 Crore.

With this move, the new-found power of the NBFCs might closely be subjected to the regulations of the Central Government.

Subscribe Taxscan Premium to view the JudgmentThe Madhya Pradesh State Government has exempted the upcoming Taapsee Pannu starrer film ‘Thappad’ from State Goods and Services Tax ( SGST ) for a period of three months.

Thappad is an upcoming 2020 Indian Hindi-language drama film directed by Anubhav Sinha. The film stars Taapsee Pannu as a woman who files for divorce when her husband slaps her. It will be theatrically released on 28 February 2020.

The Commercial Tax Department has issued a circular, asking single-screen cinemas and multiplexes to refrain from collecting SGST on tickets of the film scheduled to be released on February 28. The tax will be exempted till May 27.

In January, the government had declared ‘Chhapaak’ featuring Deepika Padukone as tax-free.

The Central Goods and Services Tax (CGST) Department Vadodara has cracked down the racket of fake invoices worth 100 crores.

Acting on the Intelligence that one Mr. Manmohan Agrawal and his son Mr. Naman ManMohan Agrawal had been engaged in the business of issuance of fake invoices without actual movement of goods to generate the Fraudulent Input Tax Credit (ITC), the officers of CGST. Vadodara-II Commissionerate, Vadodara Zone searched the principal place of business of the same duo.

The investigation revealed that Mr. Manmohan Agrawal and his son had created B fake firms, which were located in Vadodara, Mumbai, Hyderabad, and Bangalore. They were receiving fake invoices from other firms, and in tum, were passing On the fake Input Tax Credit (ITC) using 8 such fake firms generated.

The investigation further received that the fake firms located in Mumbai, Hyderabad, and Bangalore utilized the fake Input Tax Credit (ITC) in tax payment of goods purchased from registered/ unregistered taxpayers who removed their goods clandestinely.

Further, to validate the receipt and supply, they had generated an e-way bill using 7 trucks which were stationed at the single place (additional place of business) and had not moved. The investigation so far has revealed that they issued and received fake invoices to the tune of Rs.100 crores and availed, utilized and passed on fraudulent Input Tax Credit(ITC) to the tune of Rs.15 Crores.

Mr. Naman Manmohan Agrawal was arrested at Vadodara on 24.02.2020 In violation of the CGST Act and Rules framed thereunder and under section 69 of the CGST Act, 2017 and has been produced before the Special Chief Judicial Magistrate, Vadodara who had remanded him to the Judicial Custody. Further investigation is in progress.

The Gauhati High Court has asked the Central government for fresh consideration by examining the aspect as to whether the order of moratorium of the National Company Law Tribunal (NCLT) also covers the proceeding pending before the GST authorities under the GST Act 2017.

An order for payment of Rs.1,82,67,651/- on the petitioner M/S National Plywood Industries Limited was issued and further a penalty of Rs.1,82,67,581/- was imposed under Rule 173Q (1) of the Central Excise Rules, 1944. The said order has been challenged here in a WRIT petition by stating that the petitioner is held to be a corporate debtor and accordingly an order of moratorium had been passed under Section 13 of the Insolvency and Bankruptcy Code, 2016.

The Commissioner had observed in this issue, “I find that the Hon’ble National Company Law Tribunal, Guwahati Bench had passed the order dated 26.08.2019 in respect of the bankruptcy case of the assessee wherein they are liable to certain debt to the financial creditor and their properties are also controlled for the debt including any action under Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. By the order dated 26.08.2019, the Hon’ble National Company Law Tribunal (NCLT) has declared a Moratorium under the insolvency & bankruptcy code-2016 in terms of Section 14 of the said code vide which proceedings against the corporate debtor including execution of any judgment, decree or order in any court of law, tribunal, arbitration panel or other authority was prohibited. Now, the question arises whether adjudication of Show cause notices would mean an execution order or be treated as decree against them. I find that adjudication means the determination of liability against any assessee to whom show-cause notices have been served and in the instant case also there is no bar of the tax authority to carry out the exercise of the adjudication process for determining the liability of the assessee towards the department.” Relying on the view by the Commissioner, it was submitted that the said objection raised by the petitioner as regards the order of moratorium passed by the National Company Law Tribunal(NCLT) had been taken care of by the Commissioner in its order.

Justice Achintya Malla Bujor Barua, while disposing the petition held, “it is discernible that the aspect as to whether a pending proceeding before GST authority is also a proceeding as provided in Section 14- (1) (a) has not been examined by the Commissioner of GST and consequently the implication thereof i.e. if it is a proceeding whether the order of moratorium would also cover the said proceeding, has also not been looked into. Accordingly, the order dated 15.11.2019 is hereby set aside and the matter is remanded back for fresh consideration by examining the aspect as to whether the order of moratorium of the National Company Law Tribunal (NCLT) also covers the proceeding pending before the GST authorities under the GST Act 2017.”

Subscribe Taxscan Premium to view the JudgmentThe Delhi High Court held that the changeability of the activity on facilitating land and other related activities to attract service tax under the head ‘Real Estate Agent’.

The respondent is engaged in the business of the real estate. A Memorandum of Understanding was entered into, between the respondent and M/s. Sahara India Commercial Corporation Ltd. for acquiring three parcels of land.

As per the said MOU, Sahara was to acquire the land, including the cost and development expenses, and the respondent was required to demarcate the land into blocks, purchase the land in contiguity block-wise, furnish title papers, etc. to enable purchase of the land, obtain permission and approval of the competent authority for transfer of the land, and to bear expenses thereof, and bring the owners of the land for negotiation, registration, etc, to the relevant places and bear all the attending expenses.

The MOU also stated that stamp duty and mutation charges would be borne by Sahara. Advances were received, by the respondent, from Sahara, for each site, a substantial part whereof was paid to the seller/prospective seller of the land.

The Revenue was of the opinion that the above arrangement rendered the respondent liable to pay service tax under the head “Real Estate Agent” service. On the ground that the respondent had not paid service tax, payable by it under the head “Real Estate Agent” service.

A Show Cause Notice was issued to the respondent on 22nd April 2010 by the Additional Director General, DZU, DGCEI, New Delhi, proposing a demand of service tax of Rs. l,55,10,433/-, for the period 1st October 2004 to 9th December 2005, along with interest and penalty.

The said Show Cause Notice was adjudicated, by the Commissioner, Service Tax, vide Order-in-Original dated 30th September 2013, whereby the aforesaid proposed demand of service tax of Rs. 1,55,10,433/- was confirmed under Section 73(1) of the Finance Act, 1994 (hereinafter referred to as along with interest under Section 75 and penalty under Sections 77 and 78 of the Finance Act.

The division bench comprising of Chief Justice and Justice, C. Hari Shankar pronounced the judgment based on an appeal filed by Revenue against Premium Real Estate Developers.

The bench observed that the Commissioner have erred in assuming that there is service provided by the appellant to Sahara India, by treating the MOU between the Commissioner that since the land cost is capable of being known, in the facts of the present case, the profit, if any, amounts to being the consideration for service, is completely erroneous.

The bench further observed that It has also been held in the said decision that when the Finance Act levies service tax, it only levy service tax on those activities which are for providing services simpliciter and it does not provide for levy of service tax on an indivisible transaction.

Upholding the decision of the tribunal and said that if the contention of the Department is to be accepted, it will result in an absurd situation holding the profit element of a purchase/sale transaction of land, as the consideration for alleged real estate service.

While dismissing the appeal the court stated that the Tribunal erred in not treating the respondent as providing “real estate agent” service, and in treating the transaction, between the respondent and Sahara, as one of trading.

Subscribe Taxscan Premium to view the JudgmentThe Gujarat High Court has dismissed a review petition filed by the revenue department against a judgment wherein an applicant was allowed to file the declaration in the form GST TRAN-1 and GST TRAN-2 to claim Transitional Credits.

The writ-applicant in the original petition was a partnership firm having its registered office at Bharuch, State of Gujarat who was in the business of import-export and distributor of branded housewares. Their case was that the declaration in the form GST TRAN-1 could not be filed on account of the technical glitches in terms of poor network connectivity and other technical difficulties on the common portal. The Court directed the revenue to permit the writ applicants to allow the filing of declaration in form GST TRAN-1 and GST TRAN-2 so as to enable the petitioners to claim transitional credits of the eligible duties in respect of the inputs held in stock on the appointed day in terms of Section 140(3) of the Act. It was further declared that the due date contemplated under Rule 117 of the CGST Rules for the purposes of claiming transitional credits is procedural in nature and thus should not be construed as a mandatory provision.

While dismissing the review petition, a division bench comprising of Justice J.B. Pardiwala and Justice A.C. Rao of the Gujarat High Court has analyzed that, the jurisprudence on binding precedent and per incuriam. The High Court had in its earlier judgment had allowed the transitional credits on the ground that it is a vested, substantive and constitutional right and it is a property under Article 300A and not allowing carry forward of credit will be violation of Article 14 and Article 19(1)(g) of the Constitution of India. This judgment has been followed by several High Courts including Hon’ble Calcutta High Court.

Subscribe Taxscan Premium to view the JudgmentThe Chhattisgarh High Court has upheld the increased rates of development cess and environmental cess on land covered used for mining as per the amendment introduced to the Chattisgarh (Adhosanrachna Vikas Evam Paryavaran) Upkar Adhiniyam, 2005. As per the amendment to the schedule, I and II of the said Act, the rates of Development Cess and Environmental Cess were increased to 11.25% on land covered under mining lease.

The Counsel for the Appellant, Nuvuco Vistas Corporation Ltd., submitted that the State does not have any power or authority to have mulcted the liability by way of development cess/environment cess in view of the law declared by the Supreme Court in India Cement Ltd. & Others v. State of Tamil Nadu & Others; {(1990) 1 SCC 12}. He contended that the incompetence of the State stands was further asserted in this regard as per ruling rendered by the Apex Court in Orissa Cement Ltd. v. State of Orissa & Others; {(1991) supra (1) SCC 430}. It was also pointed out that the basic challenge raised against the vires of the provision/enactment is pending consideration before the Apex Court and that it was without any regard to the said course and events that the State has proceeded with the further amendment, whereby the rate of the development cess/environment cess has been increased substantially from 7.50% to 11.25% which unconscionable in all respects, and hence the challenge.

The State submitted that no interim stay has been granted by the Apex Court and insofar as the provision stands intact as on date, the course pursued by the State Government effecting periodical revision of the rate, depending upon various facts and circumstances, is within the four walls of the law and is not liable to be interdicted. It was further submitted that by virtue of the settled position of law, there is a presumption as to the validity of the legislation and until it is declared ultra vires for sustainable reasons, the provisions have to be given effect to.

Chief Justice Ramachandra Menon and Justice Prateem Sahu while dismissing the appeal held, ”After hearing both the sides, this Court finds that the course pursued by the learned Single Judge, in conformity with the view already taken by a co-ordinate Bench of this Court, with reference to pendency of the matter before the Larger Bench of the Apex Court, cannot be termed as wrong or unsustainable in any respect. It is for the Appellant to continue to deposit the cess amount as per the revised rates under protest if it be so and this would be subject to the outcome of the Civil Appeals pending before the Apex Court. As made clear by the learned Single Judge, if the issue comes to be answered by the Apex Court in favor of the Appellant, the amount so deposited would stand refunded or adjusted under other heads payable to the State Government or could be dealt with as to be ordered by the Hon’ble Apex Court, while deciding the Civil Appeals. There is no tenable ground to interdict the verdict passed by the learned Single Judge.”

Subscribe Taxscan Premium to view the JudgmentRussia has proposed a Value-Added Tax (VAT) reduction from 20% to 15%.

VAT increase in 2019 was accompanied with a mission to spend the additional forecasted revenue for national capital infrastructure. However, the expected revenue was not generated. It is estimated that the Russia VAT reduction of 5% points would result in a revenue cut but will be supported by a 5% rise in GDP.

VAT revenues will be split between the federal state and regions. The proposal is to divide it into rates of 60% and 40% for the federal budget and regions respectively.

The previous VAT rate increase was accompanied by some consequences, namely, the adjustments to ERP systems, price adjustments, etc.

The National Company Law Tribunal (NCLT), Mumbai has ordered to restore the E-way Bill Facility for Taxpayers undergoing Insolvency Proceedings.

In the case of Videocon Group vs. Central Goods and Service Department, the Goods and Service Tax (GST) Department was directed to restore the E-way bill facility for filling the Goods and Service Tax (GST), they must not take the coercive steps against the corporate debtors and GST department must receive the manual/physical filing of the GST regular returns.

The petitioner namely Videocon Group filed an application to the National Company Law Tribunal (NCLT) in order to seek directions to the Central Goods and Service Tax (CGST) Department in order to restore the E-way bill facility for filling the Goods and Service Tax (GST), they must not take the coercive steps against the corporate debtors and GST department must receive the manual/physical filing of the GST regular returns.

The corporate debtors are engaged in the business of assembling, manufacturing, and distribution of a wide range of consumer electronics and home appliances (VIL). VIL is a licensee of the “Videocon Trademark” Videocon Telecommunications Limited to provide telecom services in 6 circles across India.

The issue raised in this case was whether the Return Filing Facility can be blocked for taxpayers undergoing CIRP or not?

The Coram of the National Company Law Tribunal (NCLT) comprising of Shri Chandra Bhan Singh, a Technical Member and Smt. Suchitra Kanuparthi, a Judicial Member ordered the Goods and Service Tax (GST) Department was to restore the E-way bill facility for filling the Goods and Service Tax (GST), they must not take the coercive steps against the corporate debtors and GST department must receive the manual/physical filing of the GST regular returns. Thus, all these directions will ensure the compliance of the GST laws by corporate debtors.

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India (ICAI) has invited chartered accountant applications from technically sound candidates for the following positions on contract basis initially for a term of three years for its Accounting Standards Board, Auditing and Assurance Standards Board, Financial Reporting Review Board, Ethical Standards Board, Committee on Public and Government Financial Management and Sustainability Accounting Standards Board (referred as areas hereinafter), etc.

The ICAI is a statutory body established for the regulation of the profession of Chartered Accountant (CA) in India. During its glorious more than 70 years of existence, ICAI has achieved recognition as a global second largest Accountancy Body. ICAI has a chartered accountant Accounting Standards Board, Auditing and Assurance Standards Board, Financial Reporting Review Board and also has Sustainability Accounting Standards Board recently set up with an objective to formulate disclosure Standards related to Non-financial reporting framework in line with the Sustainable Development Goals 2030.

| Position | Minimum Professional Experience in Relevant Area | No of Positions |

| Project Officer | 18 Years | 14 |

| Assistant Project Officer | 10 years | 10 |

| Project Associate | 5 years | 5 |

Professional Background

Chartered Accountant (CA) with the above-mentioned minimum post-qualification working experience in any Statutory/Regulatory/Professional Body/PSU/ Industry. Professional exposure to the four stated areas is a pre-requisite and be specifically highlighted as to the areas in which the applicant would like to be considered while making the application. 50% of the total working experience or at least 5 years should be in the area in which the application for offering services is intended.

Pre-requisite

Interested candidates may email their structured application at recruitmenttechnical@icai.in or can send through speed post to the Joint Director (HRD), The Institute of Chartered Accountants of India, ICAI Bhawan, I.P. Marg, New Delhi 110 002.

For More Information Click here.

Read How to Become a Successful Chartered Accountant here

The Ministry of Corporate Affairs (MCA) has issued an order named Companies ( Auditor’s Report ) Order, 2020.

The Companies (Auditor’s Report) Order 2020 will be applicable to all the companies including foreign companies and it will be enforced when it will be published in the Official Gazette of India.

This order stated that every report of the auditor under Section 143 of Companies Act, 2013 must contain the matters as specified under paragraphs 3 and 4. If in case the auditor’s report pertains to the consolidated financial statements, this order will not be applied.

The order 2020 elaborated on all the matters which are to be included in the auditor’s report. Wherein, the following details of the subject-matter are described:

The Auditor’s Report Order 2020 of any company is supposed to state the reasons for unfavourable or qualified answers.

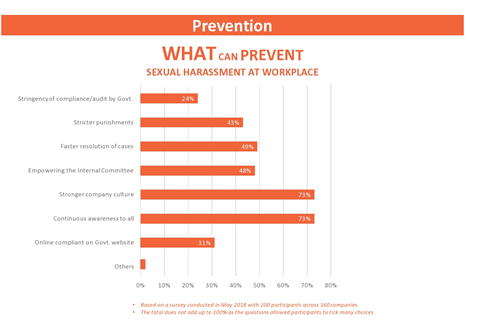

Subscribe Taxscan Premium to view the JudgmentThe Sexual-harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 ie; the PoSH Act has been enacted with the objective of preventing and protecting women against workplace sexual harassment and to ensure effective redressal of complaints of sexual harassment.

Since the uprise of #MeToo as a movement, several new situations have arisen, some of which were not envisaged at the time of enforcing the PoSH Act.

The Act extends to the whole of India and intends to protect women from sexual harassment at the workplace. PoSH Law applies to both organized and unorganized sectors.

Committees required under PoSH Act?

What is the ICC?

ICC is an internal complaints committee of a workplace to receive complains and redress complaints of sexual harassment. Every employer is obliged to constitute an ICC through a written order.

The ICC is composed of the following members:

| No. | Member | Eligibility | Term |

| 1. | Presiding Officer | Women working at senior level as an employee; if not available then nominated from another office/units/ department/ workplace of the same employer | The Presiding Officer and every Member of the Internal Committee shall hold office for such period, not exceeding three years, from the date of their nomination as may be specified by the employer. There is a lack of clarity in case of a situation in which the tenure of the IC members has expired during an ongoing investigation of a matter |

| 2. | Two Members (minimum) | From amongst employees committed to the cause of women/ having legal knowledge/experience in social work | |

| 3. | Member (External Member) | From amongst NGO/associations committed to the cause of women or a person familiar with the issue of Sexual Harassment |

The law also states that at least half of the total Members of the IC should be women. Where the office or administrative units of a workplace are located in different places, division or sub-division, an ICC has to be set up at every administrative unit and office.

External member of ICC:

The ICC should include an external member from amongst NGO/associations committed to the cause of women or a person familiar with the issue of Sexual Harassment. As per the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Rules, 2013 person familiar with the issue of Sexual Harassment may include any of the following:

The eligibility criteria for an external member of an ICC was analyzed by the High Court of Delhi in Ruchika Singh Chhabra v. Air France India and Another (2018 LLR 697). The High Court observed that in the given case, the external member appointed on the ICC by the employer was neither a member of a non-governmental organization or association committed to the cause of women nor could he establish his prior experience in dealing with cases of sexual harassment. While it was argued that the candidate was a lawyer with experience in labor matters, the High Court held that such background in law would suffice to meet the criteria for appointment of an external member of the Local Complaints Committee, but not for an external member of an ICC.

The Member appointed from amongst non-government organizations shall be entitled to an allowance of two hundred rupees per day for holding the proceedings of the Internal Committee and also the reimbursement of travel cost.

Responsibilities of ICC:

The ICC shall:

Time Limit for Making Complaint:

The PoSH Act came into effect in December 2013. Some of the postings of the #MeToo era related to workplace incidents occurring prior to that period, would not get protected under the PoSH Act.

An aggrieved person is required to submit a written complaint along with supporting documents and names and addresses of the witnesses if any to the ICC within three months from the date of the incident and in case of a series of incidents within a period of three months from the date of the last incident.

Friends, relatives, colleagues, co-students, psychologists or any other associate of the victim may file the complaint in situations where the aggrieved person is unable to make a complaint on account of physical or mental incapacity or death.

Manner to Organise workshops:

As per the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Rules, 2013, every employer shall:

Hence, the mere formulation of anti-sexual harassment policy and constitution of an internal complaints committee cannot be said to be the compliance of the Act, as there are several other obligations for complying the law which includes training, putting up posters, organizing seminars, etc.

Penalty for non-compliance:

In case any sexual harassment complaint has been proved, the criteria for determining a monetary penalty under the PoSH Act remains vague and unclear. In the absence of clarity, the IC would find it difficult to arrive at a precise monetary amount to be paid by the respondent to the complainant.

Under the provisions of the Act, for non- compliance with any provisions of the Act or rules the management shall face a penalty of INR 50,000 for their first violation and double the sum and cancellation of business license for subsequent ones.

In the judgment of Mrs. Arvinder Bagga & Ors. v. Local Complaints Committee, District Indore & Ors., W.P. No. 22314 of 2017, the Indore Bench of the Madhya Pradesh High Court has slapped a penalty of Rs. 50,000 on Medanta Hospital, Indore for not having the Internal Complaints Committee (ICC) under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013. The court has also directed the hospital to pay a compensation of INR 25 Lakhs to the complainant for failing to address her complaint of sexual harassment.

Conclusion:

PoSH Act prevents/safeguards women from sexual harassment, however, the same should not be misused by women for personal benefits.

In a judgment dated 9th July 2019, the Delhi High Court in the case of Anita Suresh v. Union of India &Ors., in W.P. (C) 5114/2015 upheld the misuse of rights provided to women under this law and slapped a hefty fine of INR 50,000 on the complainant for filing a frivolous sexual harassment claim against her senior.

Through, this judgment it is evident that the ICC while conducting the inquiry into the complaint should follow the principle of natural justice. It should serve justice to the innocent, regardless of a complainant or respondent.

Though this act looks great on a paper what it lacks the most out of the other loopholes is the “education and awareness.” The need of the hour is not just Compliance in Letter but Compliance in both Letter and Spirit.

The Central Board of Direct Taxes (CBDT) has set a deadline for the completion of the Panama and Paradise Papers probe. It has intimated the tax department’s investigation wing to complete the investigation by March 31 as per a report by Moneycontrol.

A source in the Enforcement Directorate told Moneycontrol, “Currently, we are investigating these cases under the Foreign Exchange Management Act. Once the tax department starts filing prosecution cases, we have the base to convert our case under the Prevention of Money Laundering Act.”

In 2016, around 426 Indian entities with offshore accounts were under the scrutiny of the income tax department. The department had uncovered over Rs 1,000 crores of undisclosed income in Panama Paradise Papers probe alone, in which several prominent personalities including Amitabh Bachhan, Aishwarya Rai, Sameer Gehlaut and KP Singh from DLF were named. Much of the data on Paradise Papers was disclosed by Appleby, a Bermuda-based legal services provider and Singapore-based Asiaciti, that facilitated setting up of offshore firms with low or zero tax rates.

The department may file prosecution against the entities after completing the investigation, to assist other agencies to initiate action.

The Customs Excise and Service Tax Appellate Tribunal (CESTAT) on February 24th upheld the order of the Commissioner of Inland Container Depot, wherein penal actions were taken against importers of SEGWAY products who evaded custom duties.

The appellant company M/s Bird Retail Pvt. Ltd. is involved in the sale of Segway products/Segway personal transport products purchased from M/s Segway Inc., U.S.A. The appellant has been importing “Segway‟ product in CKD condition in the form of very assemblies such as power assembly, transmission assembly, wheel assembly, etc. as well as Air Cargo Complex, New Delhi wherein they have filed bills of entry for assessment and clearance of the imported consignment declaring the product as “CKD Parts of electrically operated two-wheeler/personal transport/lithium ION battery for captive use”.

The department working on intelligence has initiated investigations against the appellant for misdeclaration of the product at the time of import and has entertained a view that the importer/appellant has imported complete units of the Segway personal transport self-balancing vehicle in CKD condition. However, at the time of the import, they have mis-declared the same as “CKD parts of personal transport/electrically operated two-wheelers for captive use and have misclassified the same under Customs Tariff Heading 87149990 and thereby has evaded huge amounts of customs duty. It was alleged that the sales manager Roni Abraham was involved in devising a technique to evade customs duty by wrongly availing benefits. The goods were seized and the penalty was imposed on these people against which the appeal was filed.

Technical Member C.L Mahar and Judicial Member Mrs. Rachna Gupta, while dismissing the appeal held, “We find that both the appellants were fully aware that M/s Bird Retail Pvt. Ltd. is importing complete Segway electrically operated product in CKD condition by is-declaring the same as CKD parts of components such as Power unit, transmission kit, etc. Both the appellants were aware that the components which have been imported just indeed screw drive technology to make the same as functional Segway product. Shri Rony Abraham, Sales Manager was looking after the work pertaining to import, preparation of import documents and liaisoning with the customs clearing agent and subsequent sale of Segway products in a complete functional form. Shri Ankur Bhatia was controlling the activity of the imports as he was financing the same and gave financial approval for various activities of the import of the Segway product. Both of them were instrumental and devising a modus-operandi to evade customs duty by wrongly availing the benefit of the Notification No. 12/2012-Cus. dated 17/03/2012. Considering the involvement of both the appellants in entire activity, we feel that the Adjudicating Authority is right in imposing a penalty upon them under the provision of Section 114A and Section 114AA of the Customs Act, 1962 and we refrain from interfering the finding and imposition of the penalty upon these two appellants also.”

Subscribe Taxscan Premium to view the JudgmentThe Allahabad High Court has denied any relief to the petitioner as there was a nondisclosure of godowns and non-payment of tax which ultimately demonstrated misconduct on the part of the petitioner.

In the case of M/s Ashu Traders Madar Gate Aligarh vs. Union of India, it was observed that the counter affidavit clearly reflect misconduct after the goods were seized and in further inquiry, it was revealed that there were 3 undeclared godowns and the petitioner non-payment of any tax or penalty or bond or security but also failed to appear in the proceedings on the fixed date. The rejoinder affidavit filed by the petitioner was vague and evasive.

The petitioner, in this case, filed a writ petition against the seizure of goods which was undertaken by the Deputy Commissioner (Special Investigating Branch), Commercial Tax. Through the writ petition, the petitioner not only challenged the order pertaining to seizure but also requested the release of the goods seized. The various affidavit and counter-affidavit were filed from both sides in this respect.

The issue raised in this case was whether the petitioner was eligible for any relief pertaining to the release of seized goods or not?

The Division Bench of the High Court of Allahabad comprising of Justice Biswanath Sommadder and Justice Yogendra Kumar Srivastava observed that “the counter-affidavit clearly reflect misconduct after the goods were seized and in further inquiry, it was revealed that there were 3 undeclared godowns and the petitioner not only paid any tax or penalty or bond or security but also failed to appear in the proceedings on the fixed date. Therefore the court in no case can use its discretionary jurisdiction under Article 226 of the Constitution of India and the petition was dismissed on this note”.

Subscribe Taxscan Premium to view the JudgmentThe Chhattisgarh High Court has ruled that the writ benefit cannot be extended to such indolent persons who sleep over their rights and duties without any plausible explanation and justification and now at the belated stage woke up from slumber and is trying to get relief from the High Court without any bona fide ground.

The Court made this observation in the Writ Petition filed by M/s Jagadamba Hardware Stores. To avail the input tax credit (ITC) under Rule 117 of the Central Goods and Service Tax (CGST) Rules, 2017, the petitioner was to submit a declaration electronically in form GST TRAN-1 duly signed on the common portal. When the rules were framed, the said TRAN-1 was to be filled by the traders by 30.09.2017. Later on, the time was extended till 30.11.2017 and then it was further extended till 27.12.2017.

The petitioner contends that, during the relevant period, the petitioner tried to fill TRAN-1 but because of the technical glitches and error it could not be filled online on the portal of the department. It was further contended that because of the petitioner being unsuccessful in filling TRAN-1 online on the portal, he could not even obtain the screenshot to show the proof of his having attempted to fill in TRAN-1. Subsequently, they approached the GST Help Desk on 22.01.2019 who asked them to approach the designated Nodal with evidence of technical glitches/error requesting to permit them to submit TRAN-1 manually which was however not accepted and has led to the filing of the present writ benefit petition.

Justice P. Sam Koshy while rejecting the appeal observed that,”. . . . there is no iota of evidence or proof produced by the petitioner to show that he has bonafide attempted to fill up TRAN-1 and was unsuccessful because of the technical glitches and errors. Moreover, the petitioner also does not seem to have approached an officer in the department showing concern about his difficulties in filling up of TRAN-1 for a considerable period of time of almost 1 and 1⁄2 years. The petitioner also failed to establish having approached any of the officers in the department, nor is there any proof in his possession. There is also no document to show any correspondence made with any of the officers in the department in this regard.”

Subscribe Taxscan Premium to view the JudgmentThe Supreme Court has transferred the petitions challenging the validity of the provision on Anti Profiteering Measure under Section Section 171 of the Central Goods and Services Tax (CGST) Act 2017 from different High Courts.

A batch of writ petitions is pending before the High Courts of Delhi, Bombay and Punjab and Haryana in which the constitutional validity of Section 171 of the Central Goods and Services Tax (CGST) Act 2017 read with Rule 126 of the Central Goods and Services Tax (CGST) Rule 2017 and other cognate provisions.

Twenty writ petitions are pending before the High Court of Delhi. Two writ petitions, which are the subject matter of the present Transfer Petitions, are pending before the High Court of Judicature at Bombay.

Section 171 has been inserted in the GST Act which provides that it is mandatory to pass on the benefit due to the reduction in the rate of tax or from the input tax credit (ITC) to the consumer by way of commensurate reduction in prices.

Section 171(1) casts the responsibility to pass on the benefit of GST to the recipient in two aspects. Passing of benefit due to reduction of the tax rate, in case of supplies exclusive of tax or for immediate services is not a big challenge. This is because the reduction in tax rate will directly be evidenced by invoices, and the recipient will get the benefit from the rate reduction. And also, Benefit of Input Tax Credit (ITC), i.e., If it is the service sector, manufacturing, trading, or any specific industry, all are going to get the advantage of the better flow of input tax credit (ITC) except sectors having zero-rated output supply. So overall the expectations of Anti-profiteering Measure provisions are commensurate reduction in prices of supplies.

While allowing the Transfer petition, a two-judge bench comprising of Justice Dr. Dhananjaya Y Chandrachud and Justice Ajay Rastogi observed that “We accordingly allow the Transfer Petitions and direct that the writ petitions shall stand transferred to the High Court of Delhi. The Registries of the respective High Courts are requested to immediately transfer the papers of the proceedings of the writ petitions to the High Court of Delhi. We leave it open to the parties to apply for necessary orders either with regard to the interim relief or for modification of such orders, as the case may be”.

Subscribe Taxscan Premium to view the JudgmentThe Calcutta High Court has stayed the Service Tax Audits against Magma Housing Finance Ltd.

The Petitioner has challenged impugned notices dated December 13, 2018, and April 25, 2019, which demands the details for Service Tax Audits.

Counsel appearing on behalf of the respondent authorities has placed reliance on a coordinate Bench judgment of the Calcutta High Court in M/s. Gitanjali Vacation villa Private Limited & Anr. vs. The Union of India & Anr. in W.P. 380(W) of 2019 wherein the Court had refused to pass any interim order

A single-judge bench of Justice Shekhar B. Saraf said that “I am of the prima facie view that the impugned notices dated December 13, 2018, and April 25, 2019, should be stayed till June 12, 2020, or until further orders whichever is earlier”.

Recently, Gujarat, Jharkhand, Calcutta High Courts had stayed post-GST Service Tax Audit.

Subscribe Taxscan Premium to view the Judgment