Begin typing your search above and press return to search.

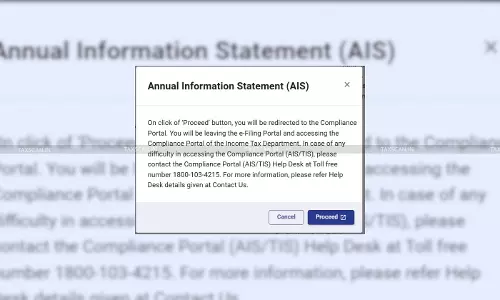

Attention ITR Filing Taxpayers, DO NOT click any links; it’s a phishing scam!: Know How to spot and Avoid it

The Income Tax Department, through its official Twitter account (X account), has notified the taxpayers to be vigilant on phishing scams. It is...

![[Exclusive] Meerut CA ITR Refund Scam: Salaried Taxpayer Still Left to Suffer after Crackdown! [Exclusive] Meerut CA ITR Refund Scam: Salaried Taxpayer Still Left to Suffer after Crackdown!](https://images.taxscan.in/h-upload/2025/07/17/500x300_2064722-meerut-ca-itr-refund-scam-ca-itr-refund-scam-itr-refund-scam-itr-refund-ca-taxscan.webp)

![Supreme Court Reinstates Quarry Lease to Highest Bidder: Quashes High Courts Re-Tender Order as Legally Unjustified [Read Order] Supreme Court Reinstates Quarry Lease to Highest Bidder: Quashes High Courts Re-Tender Order as Legally Unjustified [Read Order]](https://images.taxscan.in/h-upload/2025/06/19/500x300_2050377-quarry-lease-taxscan.webp)